How to Get Started

- Open a free account at Credit Karma to see a list of all your accounts. This will let you know where you stand in terms of credit limits, payment history, date opened, current utilization, and each account’s reporting date.

- Research companies brokering tradelines. Verify the account verification process with them. For good reason, banks don’t really like this little muse. When vetting Tradeline companies ask for proof that they are collecting all required documents and running a LexisNexis background on each client. I will also introduce you to the Tradeline Company that I use (more on that later).

- Call your credit card issuers to increase your available credit. The credit card issuers will ask for your household income. Some credit card companies do soft pulls and others do hard pulls (which can affect your credit). The card issuers that I know use hard pulls for credit limit increase requests are Chase & Barclays, so make sure to request those last (if applicable). Note that most people will get approved for $5,000-$15,000 per card. I have been screwing around with credit cards since my travel-hacking days since the early 2000’s and have some nice limits already so I am going for the moon! ($30,000+).

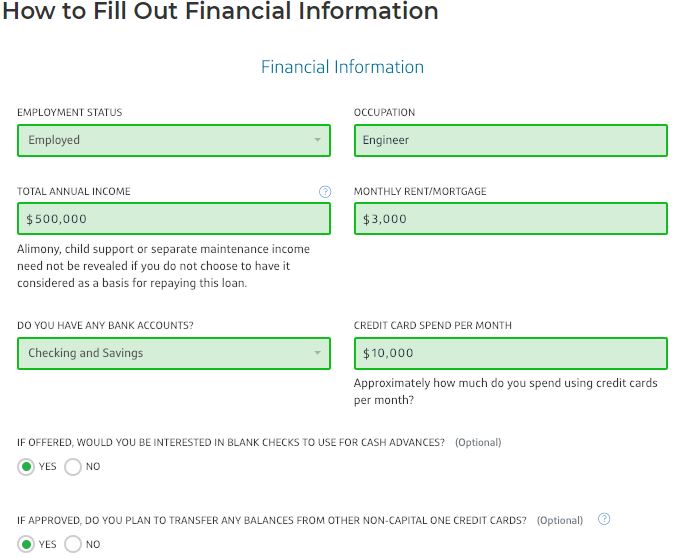

This is an example of how I filled out my financial information to get a credit limit increase.

I always answered “Yes” to questions about cash advances or balance transfers because the banks would like it if you moved other balances to them. This is because the banks would profit from balance transfer fees and the interest from overdue balances (assuming the person doesn’t pay off their credit card on time).

I discourage you from increasing the limit on cards you plan on closing (such as cards with a high annual fee that you are using for travel hacking) because when you do close the account it will have a bigger impact on your credit score.

Increasing or Consolidating your Credit Lines

Consolidating your Credit limits (CL) into one credit card can increase the payouts as well as minimize the headaches of more adding and removing AUs.

- Increase CL on Chase (Note since Chase is very strict it is recommended to not use Chase Cards to avoid getting your cards cancelled):

- Do not call in to ask for a CL increase.

- Move from Chase co-branded cards, keeping a minimum of $500 CL on the co-branded cards, and moving the rest of the CL to the cards that I can sell AU slots.

- Barclays: unfortunately hard pull on CL increase, so don’t do it.

- Bank of America: Soft pull on CL increase, rep told me that I can try to call to increase CL once every 3 months. I called 2 times and they were both approved. I wouldn’t recommend trying to increase CL within the same call as cancelling the AU card. Just make 2 separate calls to not be suspicious.

- Not possible to increase CL by calling.

- My goal is 5 new Chase cards in 2 years to comply to the 5/24 Chase rule and + 1 Barclays to age. So 6 cards in 2 years. I may add a Capital One to age 6 months after the first 6 cards (Chase + Barclays). I may not sell all the cards, like Chase, I do like their co-branded cards, but instead applying for cards to add CL to Sapphire card that I’ll sell. Tradelines mentioned that they accept co-branded cards for Barclays.