What are Tradelines?

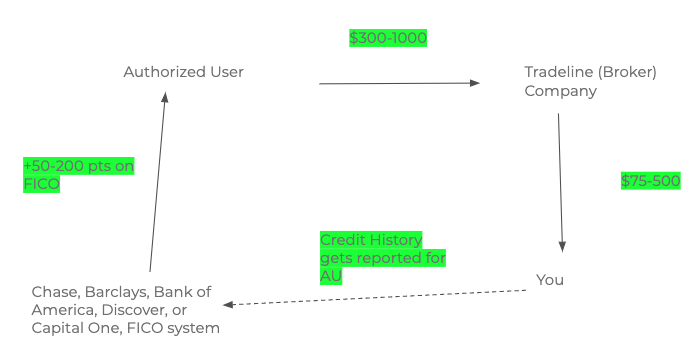

In a Nutshell 🥜: You put someone on your credit card (as an Authorized User) so that it reflects to the credit bureaus for the person. That person gets a boost in credit score and they pay you for that. Just another wealth hack we use at Simple Passive Cashflow!

A tradeline is what a bank (Chase, Barclays, Bank of America, Discover, or Capital One) calls a line of credit. Therefore your credit card is a tradeline.

You act as a credit partner. Think of yourself being a landlord for your credit but you never see your tenants nor do they mess up your credit.

A credit partner is someone who sells the right for someone else to be temporarily added as an authorized user (AU) on their credit cards.

Normally the AU stays on the account for only a couple months and then is removed. The credit partner (you) receives a commission for each authorized user added.

We call this “Tradelines.” And there is a market to sell these tradelines for others to use so Authorized Users (AU) can increase their credit score.

Where there is a need there is someone making a profit!

I know tradelines are a little weird… but so was Ebay (shipping payment off hoping to get your stuff) and Uber (jumping in a strangers car).

NOTE: This is NOT for credit repair.

Why Do People Buy Tradelines?

People buy tradelines to increase their credit score in order to:

– To get a credit card approved

– To get the best rate on loans (or even approved)

– To get business loans

– To reduce (car and homeowner) insurance costs

– To get debt consolidation solutions [Which sounds illogical]

Hack the FICO Scoring system for your own score?