Month 6 – Treating your entity like a real business

Treat your business like a business…

Alright you spent a lot of money on trust and LLCs but you will not get the full benefit if you fall victim to piercing the Veil – the “veil” is an abstract term referring to the invisible wall of protection between you and the corporation. If a plaintiff can pierce this veil then it will likely sway a court decision or increase the settlement amount.

Attorneys will tell you to:

- Do not commingle personal and business funds

- Keep entities records up to date

- Issues Stock

- Have annual meetings and document this – review members/managers, goals, journal, this might even be informal but document it!

- Failure to deal with your corporation at “arm length”

- Document loans and contributions

- Sign on behalf of your entity not for your entity (ie Lane Kawaoka, Manager, FI FOR THE WORTHY LLC)

- DO NOT commit fraud – this goes without saying but this blows up any entity

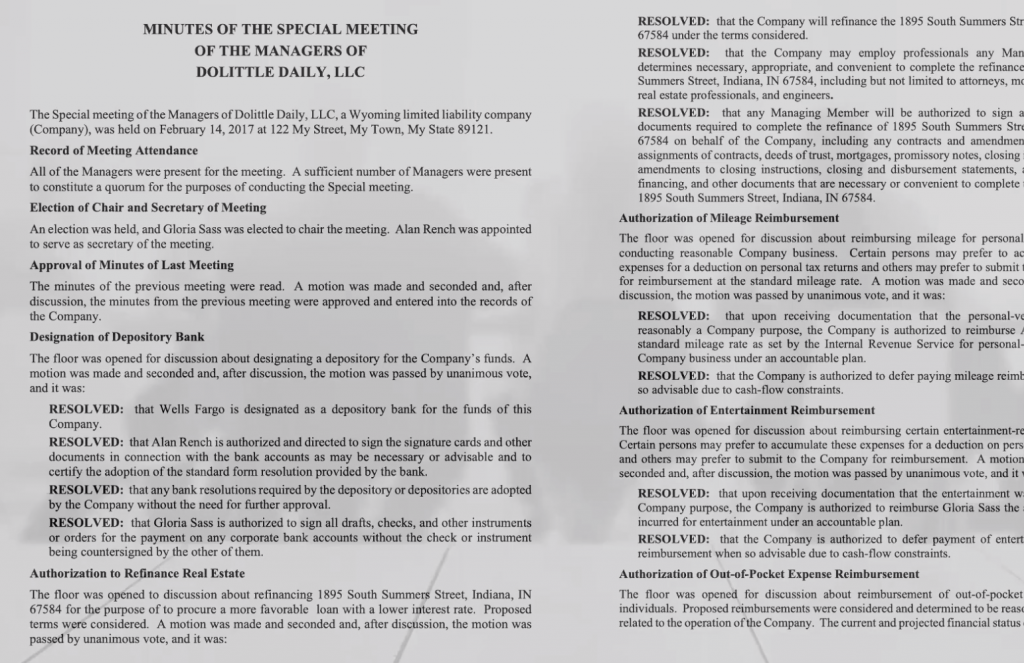

Meetings specifics to document:

- Type of meeting

- Notice required – see your docs

- Can notice be waived

- Purpose of meeting

- Who Attended

- Where it was held? Virtural?

- Did the company accomplish goals

- What are future goals

- Any resolutions – topics (appointments, removals, mergers, amending articles, asset sales, capital and debt outlook)

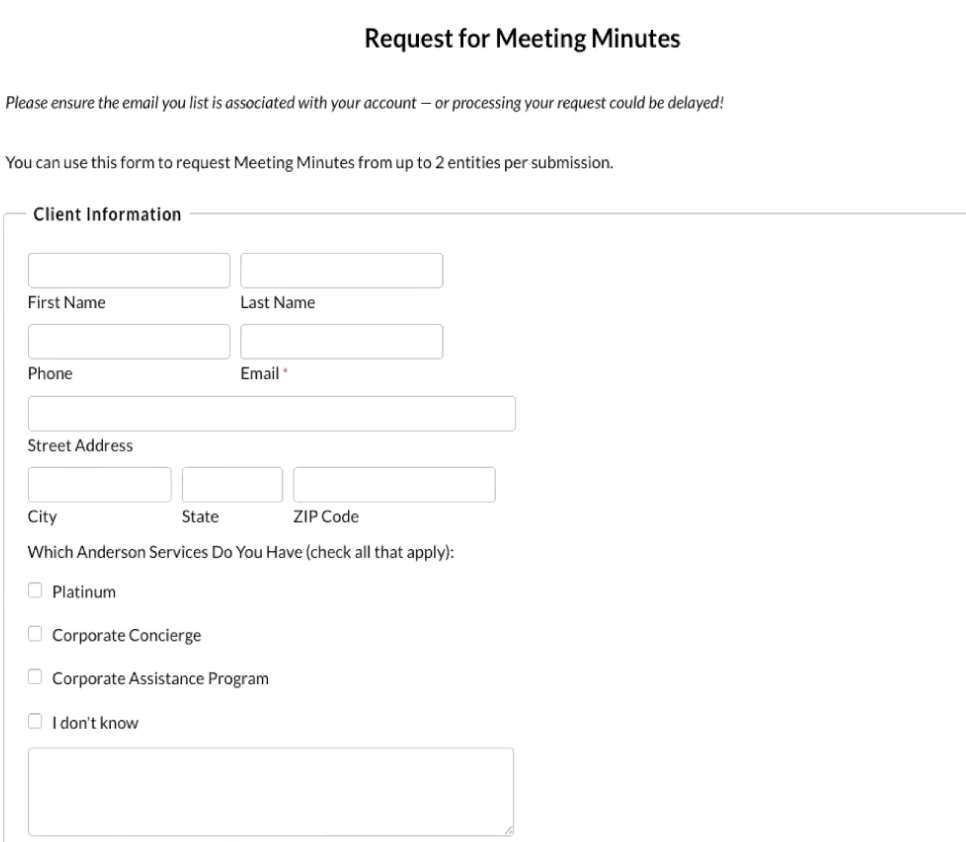

My CPA/Attorney has a quick webform for me to enter it in a couple minutes and not get bogged down:

I tend to take the approach of “Business in the front and party in the back“. From a records and documents prospective I look like I have my stuff together. If I ever had to go into court I want “everything in my outlined manila folders” with all these meetings documented.

A little overkill but this is a good example

FAQs

What is the best way to keep day to day decisions in the business?

Keep a journal. And try to document in your monthly/quarterly/annual meeting notes.

What other things should I capture in my monthly meetings?