How Much Can I Make?

You can make $5-10K+ (taxed as ordinary income via 1099) with minimal effort from a Tradeline Supply Company.

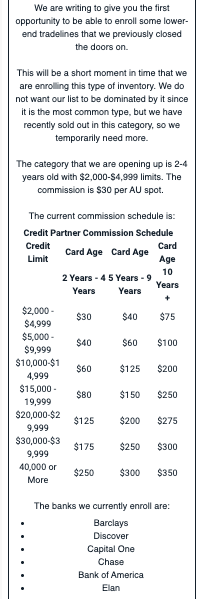

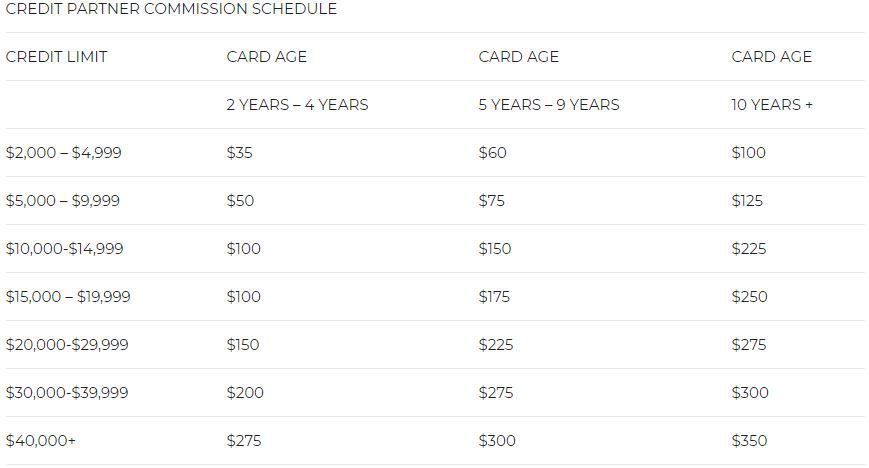

This table shows the typical commission schedule. The longer you had your credit card and the higher the credit limit, the more money you will make.

However, I have seen new cards receive as much as $100 per Authorized User (AU).

Tradelines are a simple and great for people who have tapped out their liquidity and retirement accounts!

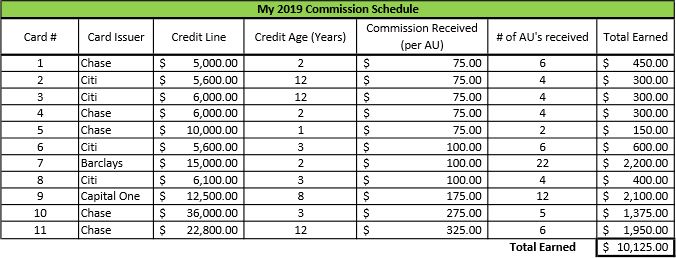

I made $10,125.00 in 2019 from my tradelines! I used 11 credit cards, the table below shows the commissions I received for each card.

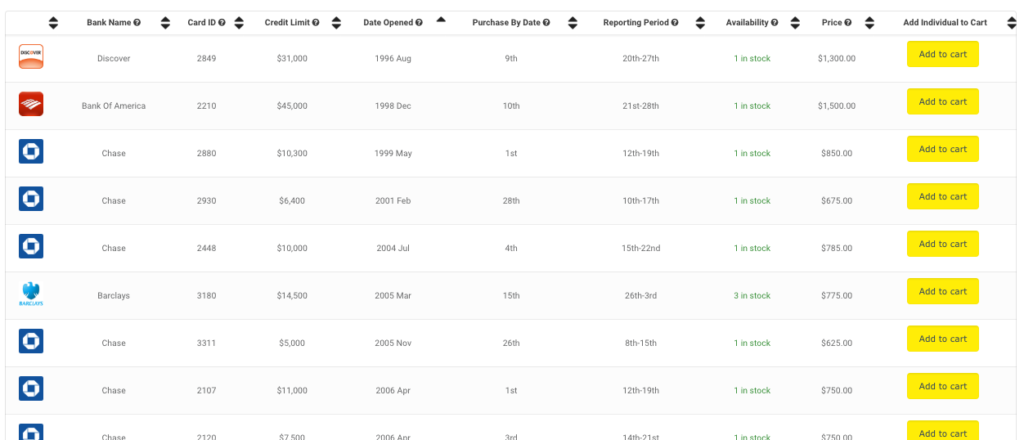

The table below shows what the AU sees when they are looking to purchase a tradeline. Your profit are the prices the AU pays, minus the intermediary fee that the Tradeline Company takes.

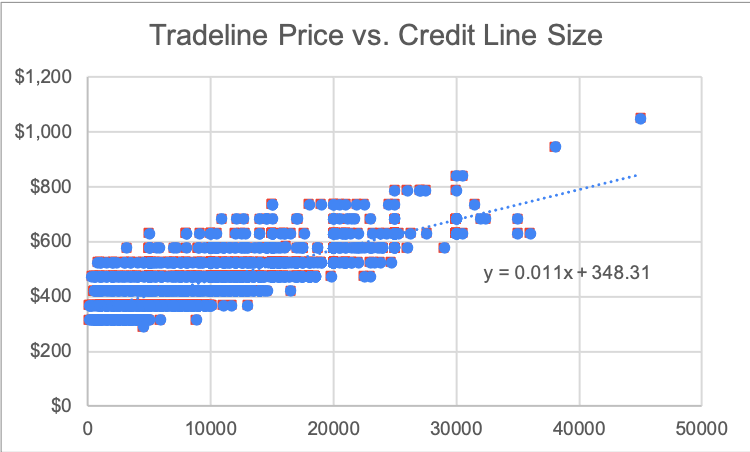

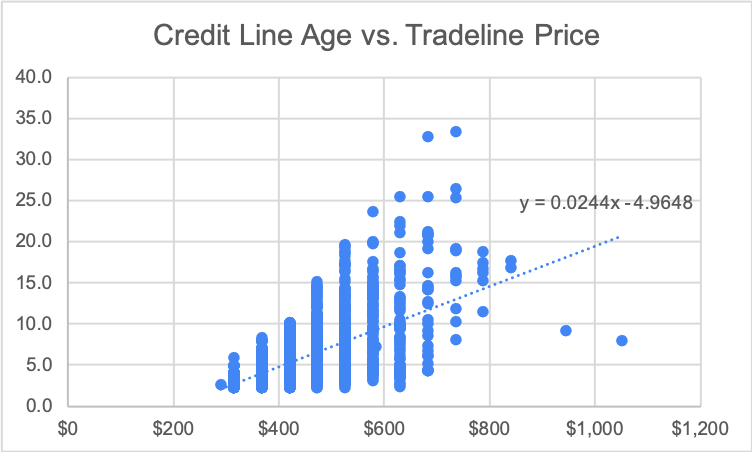

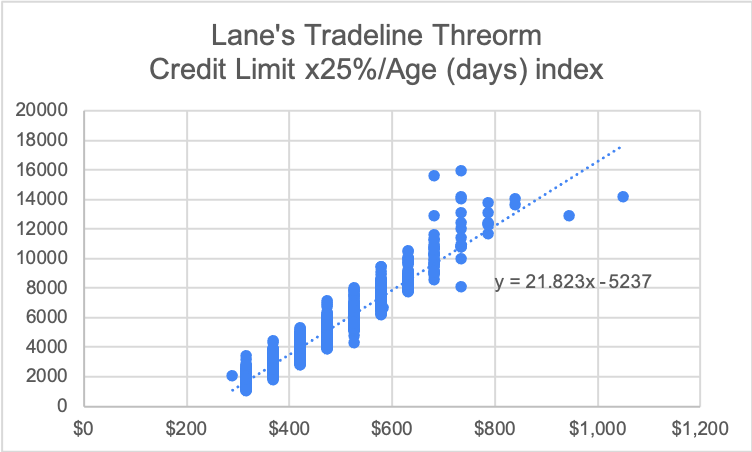

The following was derived from a data set of 1500 credit cards from one vendor. So pricing might not be accurate due to broker commissions but the important takeaway here is to notice how closely credit line size and age plays a role in determining the price of the tradeline.

How to Scale Your Tradelines

Credit card issuers have a limit to how many AU’s can be added (the maximum AU’s varies depending on the issuer). However, it is recommended to start with one AU to get comfortable with the process. Once you’re comfortable, you can start adding multiple AU’s on different credit cards. Just keep in mind that with more AU’s you have, the more organized you have to be, I recommend making a spreadsheet.

A 680 credit score is usually all you need to get the top tier Fannie or Freddie loan. Because I am no longer a homeowner and I do more private placements, I don’t really need personal credit. So that means I get to play around with all the travel hacking credit cards I want. Of course I double dip with Tradelines as I let the new credit cards season at least two years.

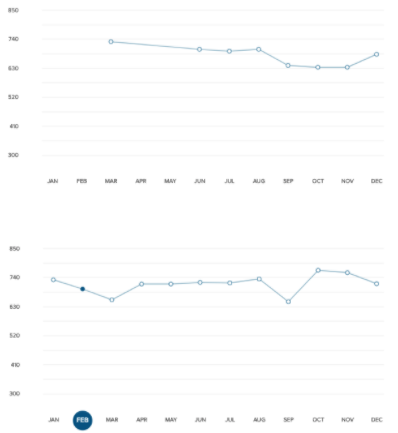

Below is my credit score for the past couple of years:

Generally, it may not be worth it for under $50 tradeline sales due to the headache and remote risk that your credit card getting cancelled.