Living Log of New Changes in Tradelines & FAQ

Bookmark this section to review every month or two. And email Lane@SimplePassiveCashflow.com to alert our community.

Living Log of New Changes in Tradelines (Last updated 21.11.22 ) – Date found

I do try to use all the cards I sell at least once a month. I automate by setting up Paypal business account subscription. So personal card subscribe to my paypal business account. There’s a fee of $0.01 per transaction to paypal.

For almost $0 start up cost and almost 0 hours put into this, I feel like this $486/month cashflow is worth it.

You’ll also notice that one of my original BOA cards below got closed by BOA, because originally, I didn’t put any spend on it. Reason for closure was that there were no transactions for >18 months 21.11.22

Discover Cards: We have been able to confirm directly with Discover that they say their new policy is 7 AU’s every year, possibly on a rolling 12 month cycle. However, we are also watching our statistics closely and we have more than one confirmed instance of a credit partner still being able to add an AU with more than 7 AU’s in their history in the last 12 months and more than one instance of a credit partner with less than 7 AU’s in the last year being restricted on adding AU’s. Therefore, it does not appear that these rules are being enforced uniformly across the board with everyone. In response, we have temporarily reduced the maximum number of AU’s to one per Discover card while we continue to monitor and track stats on the situation. If you receive a message from Discover saying that you cannot add another AU until a certain date, please let us know that date so we can note you account. – 20.10.14

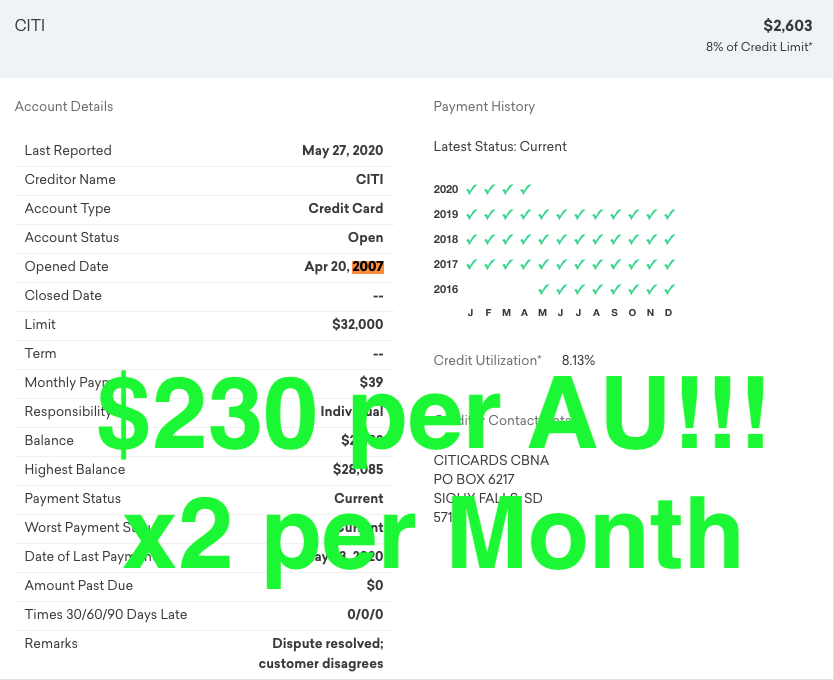

10% rule of total credit limit – In order to reflect to AU’s profile positively you should keep that card under 10% of credit limit – 20.10.12

Barclays cards have a limit to how many AU they can have in a lifetime which is 25 – 20.07.8

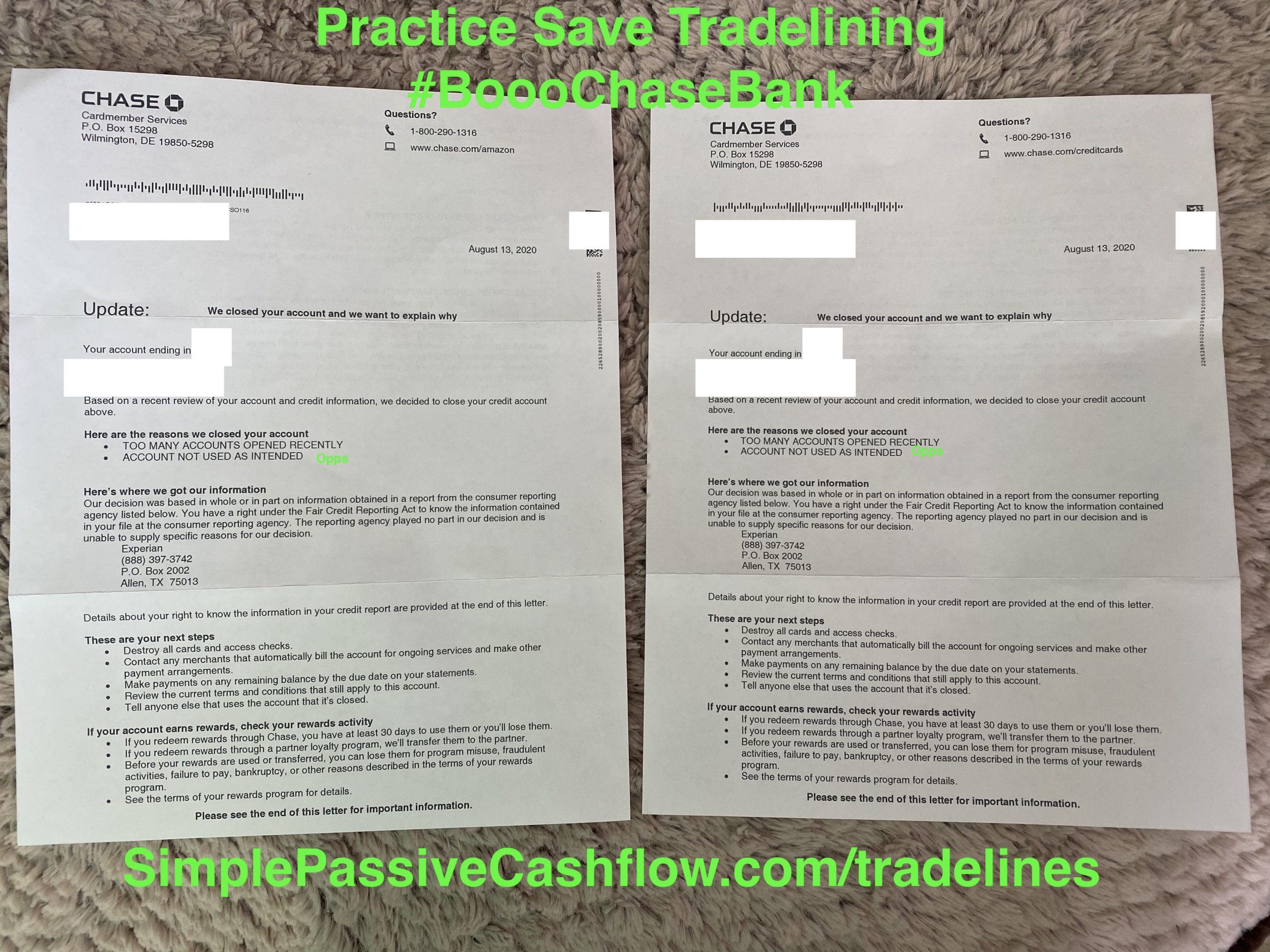

Chase is very good about tracking strange activity and have been know to shut down cards. It is advisable to run your interval and frequency at least 50% of max cycling or use only one AU at a time and delay when your card is up for trade-lining. – 19.08.1

I went down to 1 AU at a time with Chase and still got cancelled 🙁 20.08.27

FAQs

Please note that some aspects of Tradelining will change which is why it is important to say a breast to our online community.

I have 2 orders that came in today for the same bank, not the same card. Do I need to add them on different days if it’s the same bank or do I only need to take that precaution with the same card?

That is really up to you and depends on which bank. Generally it does not matter and remember that the first constraint is fulfilling the order from the customer in a timely fashion first (usually 2-3 days). If you want to be conservative then you should stagger them especially on the same card… with it being different cards on the same bank then perhaps you don’t need to be as conservative. If you are really paranoid about having your cards cancelled perhaps you should limit the number of cards or authorized users per card (to only 1).

What other things do I need to do once up and running?

Reminder use your cards once or twice a year. In this time of uncertainty banks such as COVID19 are closing lines to clean up liabilities.

Also stay turned into our group chat for the latest. Not saying you need to login every week or month but check back in once or twice a year and contribute and review the digital chatter you missed.

And always be monitoring your new cards when they get past the 12 month threshold since you can start selling those lines.

I found this the other day in my Credit Karma account by chance!