Month 6 – Credit cards for your businesses

Business cards that are connected with your EIN not your SSN is the gold standard in protecting your corporate veil. For almost two decades I have been an absolute ninja with the best credit cards with the best promos and cash back terms however when my net worth went well beyond 1M I decided I needed to grow up and forgo that extra 1-2% cash back and start using dedicated business credit card along with not commingling personal and business funds for simplicity sake.

See our living 2020 list here.

Other Credit cards to consider:

- USAA

- University of Utah Credit Union

- Zions Bank

- Ally Bank

- SoFi Money

- First Republic

- Pentagon Federal

- Alliant Credit Union

- Alaska USA Federal Credit Union

- University of Arizona Credit Union

- More at https://creditcards.usnews.com/business

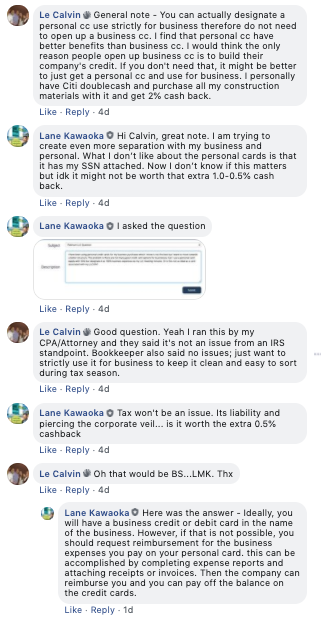

Question to CPA – Can I use a personal card (apply with SSN) but designate it as 100% business expenses via my LLC meeting minutes. Or is this not as ideal as a card associated with my LLC EIN?

Answer from my CPA: Ideally, you will have a business credit or debit card in the name of the business. However, if that is not possible, you should request reimbursement for the business expenses you pay on your personal card. this can be accomplished by completing expense reports and attaching receipts or invoices. Then the company can reimburse you and you can pay off the balance on the credit cards.