Credit Card Issuers

Only work with the very best banks for this tradelines program. The banks need to be reliable when posting authorized user (AU) data to people’s credit reports. Preferred banks are: Barclays, Discover, Capital One, Chase, Bank Of America (Note Barclays allows 6 AUs per account whiles others allow 2 AU per account.

- Capital One – Use tight spending limits on the authorized user card or entire account. You never know what can happen even if you have the physical card. Capital one has a “Wallet App” (not the Mobile App) you can actually lock the authorized user’s card. I like to use alerts on all my cards.

- Discover – Look out for the checkbox to designate the bank to NOT to issue an authorized user card. With no card being sent through the mail (or in existence) you are much safer. Also add a phone password to your account.

- Bank Of America – In your online account you can set up customized alerts. Also add a phone password to your account. Update 2/18/19 – recent Bank of America audit, reduce the available number of AU’s for sale to just one AU per card.

- Chase – In your online account you can set up customized alerts. Also add a phone password to your account.

- Barclays – In your online account you can set up customized alerts. Also add a phone password to your account. Look for the checkbox to designate the bank to NOT to issue an authorized user card.

- Citi – Citi cards are able to move around credit from one card to another. With many of the thresholds at 20k to be a useful card you might think about calling up the bank to combine smaller cards to one bigger one.

- American Express – American Express cards are poor at posting rates to the Credit Bureaus so they are unreliable with regards to boosting the credit scores of those authorized users and therefore are NOT used.

My Game Plan

I tried to apply to new cards more for the long term future (5+ years) you might get a big credit line that gets $100 per AU. I applied in the following order:

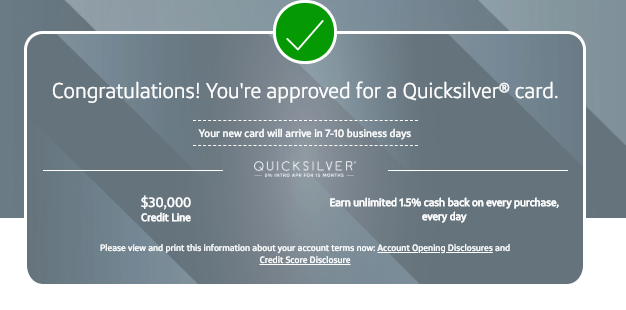

- Capital One® Quicksilver® Cash Rewards Credit Card – The plan here is to put all new purchases here and pay off or use the Chase Slate’s 0% balance transfer rate and zero balance transfer fee to shift over the remaining balance in 15 months. As you can see below I was approved for a $30,000 credit line, which means about $600 per AU that signs up!

- In 14-15 months from now, the game plan is to apply for the Chase Slate: 0% for 15 months on balance transfers, $0 balance transfer fee for 60 days, $0 annual fee. This way I can take a balance transfer check and max the card out and pay the minimums for 15 months.

- 2-3 years from now the plan is to get the Chase Freedom Unlimited (if it’s still around) to do the similar thing. The reason I am doing this last is because unlike the Slate card which has 0% balance transfer fee the Chase Freedom Unlimited card has a 3% balance transfer fee. The Quicksilver card is superior because I get 1.5% cashback instead of the Chase Ultimate Rewards points.