Choosing an Authorized User

A background check on all clients is a MUST!

Keep the number of AU’s to two and under per card. Or better yet, start with just one until you feel comfortable with the process. It’s best to start slow so you don’t get flagged for fraud.

Never add or remove more than one user at a time, especially if the bank requires you to call in to remove an authorized user (Call back 5 minutes later and you will talk to a different customer service representative).

This rarely happens, but if a bank calls or emails you requesting a call back to confirm the addition of the AU they may question the relationship to the AU and you can respond “They’re a friend or business partner”.

Make sure all AUs stay on your card for 90 days minimum. When your tradeline company tells you to remove an AU from a card, DON’T DO IT, unless at least two months have passed (preferably three).

Choose an AU who has good payment history, low (<10%) utilization, and a long (5+ account history). Use the 3 Credit Bureaus (TransUnion, Equifax, & Experian) and receive a consumer’s credit card history from the consumer’s bank(s) every billing cycle.

NOTE: If you slap additional AUs on and off a card too fast the bank will cancel your card. Selling tradelines are not illegal, but the bank will not like it if they know what you are doing, the bank can cancel your card and tell you to not come back.

When inputting the AU’s name, date of birth, etc. make sure you enter the authorized user’s address. NOT your own address. This allows the profile to post correctly to the credit bureau and ensures the AU gets what they are paying for.

The whole point of doing this is so that the new credit line shows up on the AU’s reports. If the customer (AU) reports a “non-posting” after or near the 60 day time period, the Tradeline company may make the decision to pay a full or partial commission on a case by case basis. If a customer reports a non-posting immediately after the first reporting period, then the commission is not paid.

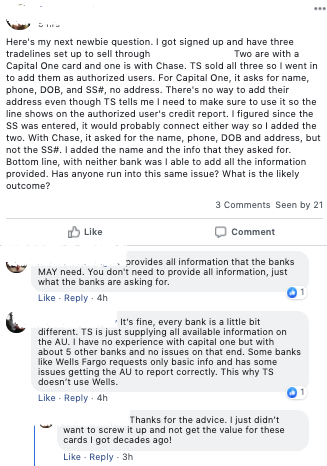

Adding an Authorized User

- Wait until you get an email or text alerting you that you sold one of your tradelines.

- Follow their instructions for adding an AU. Usually it will go like this:

- Log in to your Portal

- Click order details -> New Orders -> AU Details

- Add the AU details to your credit company’s website

- When you get an order it’s a little weird. You get their name, DOB, SSN.

- Then go back to your portal and click confirm under “New Orders”

- The credit card company will send YOU a card for the new AU

- It’s best practice not to activate the card to be extra safe.

- In two to three months the Tradeline Company will inform you to remove the authorized user.

- Follow the instructions the Tradeline Company gives on how to remove an AU from your account.

- Collect a check and feel good that you helped someone raise their credit

- Then the cycle continues for that particular account!

Best Practices

- Keep an Excel spreadsheet listing all AUs, when you added them, which card the AU was added to, when the AU is removed, and when you get paid.

- After you get authorized users on your card best practice is to either lock the account or set spending limits (business cards).