What is a Syndication?

A syndication is the pooling of capital to invest in an opportunity. The benefit of putting capital together is that it might make it possible to purchase something that one person or small group may not be able to on their own with a Joint Venture agreement.

We use syndications to get into opportunities to get away from the mom and pop chaotic and highly competitive space of under $1M-$2M deals. In addition, we try to stay under $10M-$20M purchase price sizes so we do not compete with larger institutions or hedge funds who are mostly interested in capital preservation not optimizing equity growth.

You can syndicate anything from a shave-ice store 🍧 to a multi-million dollar development 🏨. I just try to stay in my lane and focus on cash-flowing real estate where tenants’ demand is high.

I have been in many celebrity-studded masterminds…

but I wanted to create my own just for busy passive investors

My Experience with Syndications

In 2016, I paid over $30,000 to get the mentorship to be an apartment operator/investor. What I learned in the process was that I did not need to be a General Partner because I had enough income and net worth to invest as a Passive investor (LP). After doing turnkey single-family homes from 2009 for 7 years I was ready to graduate to bigger deals as a passive investor.

Since then I have been General Partner and Limited Partner on over a dozen deals from 2017-2018.

2019 UPDATE

The road to financial freedom has not been a smooth path as I have been faced with one bad partnership where I had to invoke the vote of my LPs to remove an operating partner. This experience changed my strategy where:

- Work with fewer, proven partners

- I made it a point to always have a controlling part of the GP in case I need to make changes as a fiduciary of my LPs

- In addition, stay away from "daisy chain" deals where there are 5-15 capital raisers which violate SEC laws and put the whole GP/LP in danger

News on the street is that some operators (GPs) and LPs are getting letters for investigation from the SEC… this is exactly why I keep things quiet to our Hui Deal Pipeline Club and prefer to firewall with what others are doing. More info.

Two Types of Syndications 🏢

There are two forms of syndications:

Single

A single (of a finite number of assets) that are going to be put into the ownership entity. For example, we are going to syndication the purchase and rehab of a 200-unit apartment complex at 123 Main Street. The assets are identified before capital is raised. This allows sophisticated investors to vet the deals on an individual basis.

Blind Pool Fund

A Blind Pool Fund (like a real estate fund) where capital is raised based on the sponsor’s vision, track record, and reputation. The capital is raised first the sponsors will then go out and acquire properties.

What are the Various Roles in a Syndication?

Whenever you are learning something new like ballroom dancing for example it’s best to learn the definitions first. Then once you understand those we will build upon the concepts. Remember mastery only happens with the right Mastermind and actually jumping into deals.

Investors

Investors are known as Limited Partners (LPs). Not giving you any legal advice here of course, but 80% of my investors invest in deals via their personal name because as the name implies there is limited liability because the liability goes through the GP first and the loans are guaranteed by the KPs.

What is an Accredited Investor?

- Made a minimum of $200,000 ($300,000 if filing jointly) in the previous two years

- Have a net worth of 1 million dollars excluding personal residence.

The significance of being an accredited investor is that you can invest in things that those with less money, cannot. You can also be something called “a sophisticated investor” which has a much more nebulous definition but essentially says you know what you are doing even if you don’t have that much money. These laws were put in place long ago to “protect” the average person from predatory activity. The irony of this all is that there is no protection for the average Joe, or pension funds for that matter, against investing in a wildly bloated stock market at record valuations.

Every major trader out there knows we are in a bubble, but there is no protection for individuals dumping money into their retirement accounts to buy mutual funds. It’s an archaic system that makes little sense.

Certainly, there has been some recognition of this fact. The 2012 JOBS act made it easier for Main Street America to participate in “alternative” investments via crowdfunding and made it easier for sponsors to advertise previously unknown opportunities. However, we have a long way to go. I would advise you that you need to know the lead syndicator personally. None of this “we met at a local REIA and he pitched me his deal”. If a guy does not have a list of solid investors they must lack the track record.

Also, I did a podcast with Amy Wan a syndication attorney talking a lot about this topic.

Sponsor/Lead/Co-Sponsor/Manager/General Partner (GP)/Syndicator

There are many terms for this person or company that organizes this investment and that is responsible for managing the whole operation on behalf of the investors. They are interchangeably known as the Sponsor, Lead, Manager, Operator, or Syndicator. Being in over a dozen different arrangements I can tell you that sometimes there can be a lot of dead weight in a GP however if you are looking to be in the GP you need to help with the deal with:

- Finding the deal

- Doing the grunt work

- Bringing in a lot more capital than a typical Limited Partner

The loans (financial liability) are guaranteed by the Loan Guarantors or Key Principals (KPs). You guessed it! Typically a “rich dude/gal” with a net worth of over $2-5M is signing on the debt for the entire GP and Syndication.

You can get compensated for this but every case varies which determines if it is a good risk-reward. If you are a “rich dude/gal” we should probably connect and you should enroll in my mastermind with over 50% accredited investors too. But for the rest of you under $2M net worth keep reading…

Legal Structures

As mentioned before, the syndication may be created with a certain tax and legal structure. It is usually created as a Limited Partnership (LP) or a Limited Liability Company (LLC) to own the property on behalf of investors.

Two Typical Syndication Methods

Most deals are put together with the following structures which follow the SEC’s governances.

Regulation 506B

90-97% of deals out there accept non-accredited investors and the GP cannot openly market the deal to a non-private list (no TV, Radio, social media ads for example). Investors (LPs) will self-certify if they are accredited or non-accredited.

Blind Pool Fund

The minority of deals following the new rules where you can advertise into the free world but the SEC says if you do this you cannot bring in non-accredited investors. Investors (LPs) will need a third-party letter from a lawyer, accountant, or third-party site like Verify-Investor validating Accredited status.

The Process

The following is how the process typically works.

- Someone finds a deal

- GP ties up the property in a contract and starts building their GP team. (This is where they call me and see if the Hui Deal Pipeline Club is interested in the deal).

- The GP performs their due diligence and in parallel, they get the syndication lawyer (not another run-of-the-mill person who happens to pass the BAR) to create an investment package typically referred to as a Private Placement Memorandum or PPM. The PPM includes details of the property/deal, terms, sponsor contribution, equity splits, projected returns (proforma), fee structure, payout structure, and other marketing. The PPM is a heavy document over 100-pages. In most cases, it scares new investors because it discloses all the risks that can happen. In the end, it does two things: 1) Signs the GP up to be fiduciary to no lie, cheat, steal, and run the investment to the best of their ability and 2) Signs the LP up to minimize their ability to sue the GP in case the deal does not go well after all in everything there is risk and sophisticated investors know this.

- The GP will then go about raising money from investors (LP). They will decide a minimum investment amount based on the downpayment needed, cash reserves, capital needed for extra construction, fees/compensation for putting the deal together. Experienced GPs will always write the PPM to allow some wiggle room in case an extra 5-20% of capital is needed so they don't have to spend another $10,000 for another irrevocable PPM. I am mentioning this because a common question from LPs is why does the PPM say the max raise is $4M and the sponsor just told me their take is $3.5M? As an LP it is important to understand the rough breakdown of what the initial capital raise is being used for. Beware if capital is being raised to pay out investors in the first year. This is technically a semi-legal Ponzi Scheme but is not a good best practice by a GP and a way of tricking unsophisticated LPs.

- Once there is enough capital and the financing is worked out, the property will be purchased and the sponsor manages and operates the property. This is always a monumental movement as millions of dollars are being wired in from dozens and dozens of LPs in just a matter of days.

- After the property is acquired the fanfare and excitement goes away and the GP rolls up their sleeves and gets to work. Distributions and profits are given as outlined in the PPM. In a way the LP courting stage is over, the wedding was a blast, and now we see how well this marriage lasts/goes.

Why Did I Focus on Being an LP?

Again for me, it was simple math. The assumption was that my money would grow at 15-20% a year in cashflow, equity, and forced appreciation. The syndications that I do are not BS REITs and RE Funds where you know the people running the deal for you and you don’t have layers of people taking hidden fees.

I get all the pass-through tax treatment and depreciation and interest expense. In fact, it is stronger than my direct ownership rentals because of cost segregation and bonus depreciation.

What I give up for control (most of which is an ego thing) I gain in diversification (multiple partners, markets, business plans, and asset classes). And the property management is typically a lot more professional than the property managers in the residential (1-20 unit) world.

What are the downsides of a Syndication?

Syndications as an LP are for people with money. If your net worth is under $250K it’s cool to learn but you really should not think about investing in one. Being an LP is more of an end-game strategy or once you have hit your critical mass point.

With syndications there’s a lack of liquidity. Should something happen in your life like someone kidnaps your child or your spouse wants your holdings it’s almost impossible to get the money out. Again not for broke people.

Lack of control. The GP calls the shots and you are on for the ride. Then again most LPs are amateurs and at some point, it’s better to give the wheel to the pros.

Costs and fees can be misleading. You have to find another deal when it exits. Although I find this fun!

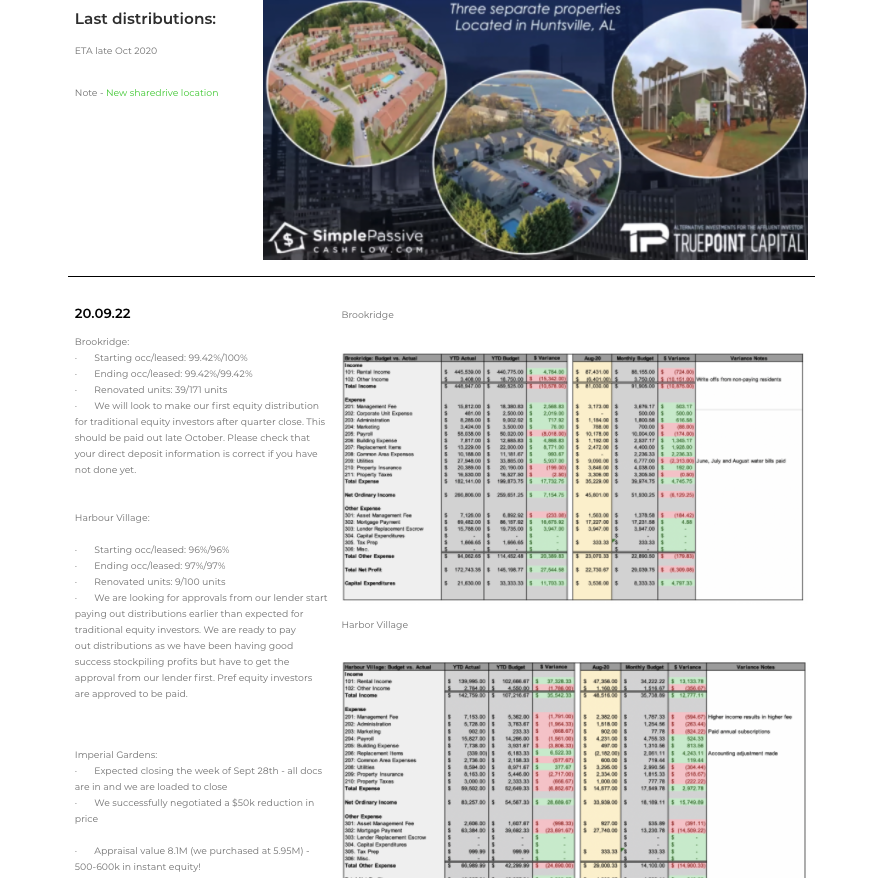

Sample of a Past Monthly Report

Active Investors (Under 500k Net Worth)