Start Here

Welcome to the Journey to Simple Passive Cashflow!

And I hope to meet you in real life at a future SimplePassiveCashflow.com Event!

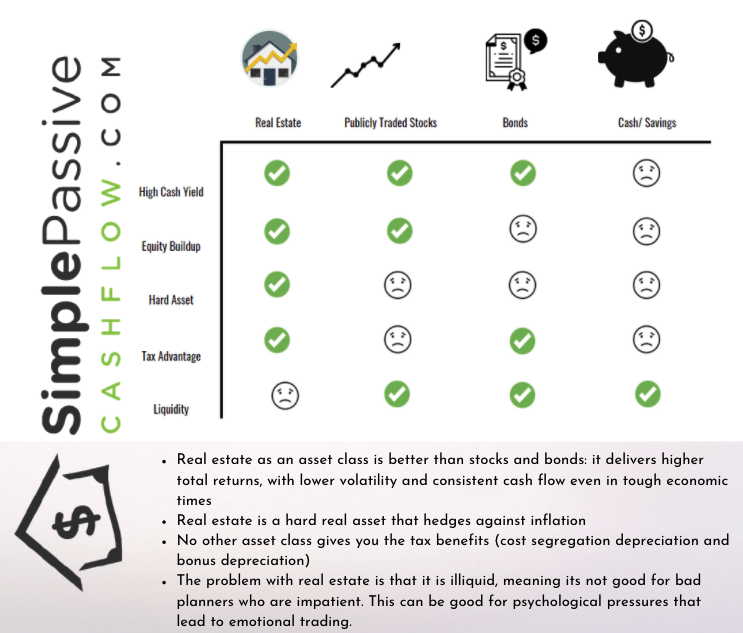

Investment Return vs Risk

Don’t be a stranger! Hui Investors I want to hear from YOU on an annual basis!

Investors in our deals and especially Mastermind members get direct access to me.

Below is a walkthrough of a few Huntsville deals from 2018.

Do You Own Properties? Find Out When to Sell Them!

Admin Note: If you haven’t already, please take a moment and add my email address to your approved sender’s list, so you don’t miss any important communication from me!

You can do this by adding me to your contact address book in your email browser.

Click Here after you added me to your contact, so I don’t have to follow up manually. Still, don’t know how to “safe list” this email check out this tutorial.

Those who do not open emails are typically removed from our future newsletters and educational emails. So please stay engaged or let me know how I can make these emails more valuable to you.

My Story & 4 Investing Concepts

Welcome to the Hui Deal Pipeline Club!

If we have not connected yet we will need to do a required onboarding call. We are a boutique syndication company where we know everyone personally 🤙

Once you complete your on-boarding call we will unlock additional training modules in your membership portal as well as all our past deal webinars for you to get more familiar with us and syndications in general.

Here’s are the most “frequently asked questions” when it comes to partnering with us.

Secrets of Syndications (From the Syndication eCourse)

The following is a fraction of the content you will find in our Syndication eCourse. To purchase it go here.

Video Notes

- Distressed property

- New development

- Stabilized/Value add

- Yield deals

- Monthly reports include profit and loss statement, living log page

- Quarterly reports with contribution from third party accountants

- REITs are retail products, marketable securities

- GP and LP are aligned in the syndication

- Investing in syndication must go above mom and pop investor

- Large institutions want to buy in, to put into the REITs/ big portfolios for retirement, retail buyers

- Returns are not guaranteed

- Reason why you invest in stabilized assets

- Don’t worry about the pref, worry about the deal

- Reasons why inventors can’t pull out their investment except if a family member is in need of help

- Bank as the biggest partner while general partners are at the bottom where they get to be paid last

- Reason of having common hold time, time shared period for our type of syndications

- Baseline is if we can get out before 3 or 4 years with a 20% plus returns

- Will be reported to passive investors

- Getting other operators on board just in case something happened to the main operator

- Why educating yourself is key

- Invest in people you trust that have good track record

- Why you should never share your e-course logins

- A lot of competition (but didn’t mention any specifics)

- Other syndicators are simply boosting their marketing

- Moving towards larger assets with 300+ units since it’s more robust

- Explanation of 506B and 506 C

- Sophisticated investor etiquettes

- Prone to become victims of syndication deals in case SEC will relax the rules

- Why best deals are open to accredited investors

- When getting a loan for a deal, the general partner signs up the loan loan, and is guarantor of that deb

- Debt doesn’t go in any of the passive investors

- Having a straight split: you get paid and we get paid, if the deal does not do well then we don’t do well

- LPs are not encouraged to be involved rather than providing investment

- Sponsors prefer passive investors who bring in their money routinely and then doesn’t say a thing

- Deals getting from broker

- Depending on the situation of the property possible a month or two

- Better to join the family office group to get insider information

- Briefing investors that we’re testing the market before selling

- Same thing like multifamily, we can put it out in the market, test the market

- Relevance of being an LP partner in having very little to no liability

- NO need to worry about preservation of capital

- Needs to be educated first (going to syndication e-course)

- If they will invest, they need to verify and try for themselves

- Capability of managing an infinite amount of deals since we hire people and delegate

- Choke point occurs is there’s a lot of paperwork that goes especially in closing

- Minimum is $50,000 but depending on situation it can be $25,000

- Having existing profit and loss statement

- Having run rates for the last two years and checking what it is

- Realizing that we’re not the best at everything

- Hiring third party professionals

- Need to consult a lawyer

- Set up a trust rather than a will

- Why there’s no GP course

- Why LoopNet brokers are not a good option

- Check track records when getting into real estate deals

- On average tenants move out in 2-3 years

- Explaining three goals of any project

- Depends on what the deal calls for

- Use long-term Fannie Mae, Freddie Mac deals on more yield type of deals

- Do a bridge loan on value add deals

- Reason why we do not cash out refinance or 1031 on exit

- Paying taxes on capital gains

- Consult a CPA for tax and legal advice

- In the year 2022, getting a hundred percent of the bonus depreciation

- Reason why there’s a change on property manager at one point

- Some syndicators creating confusion into these terms

- Others call this returning back your money (principal) plus gains or 200% earning

- If your investment made money you need to pay tax

- Phantom income explained

Let’s just get down into it and tell you what’s up, right? Because better you find out now then into the deal and you’re unhappy. Absolutely. So the first question biggest mistake, accredited investors may, I think that, where do we start with this question?

Maybe one, like a credit investors are usually not very sophisticated investors. A lot of them haven’t owned rental property. So they just look at like the pitch deck, if it’s nice and shiny, and they look at the performer return, is it making 20% a year or 20% IRR?

120% in five years. That means nothing. You can change any number on the spreadsheet to get what you want on formal. Yeah. I think that e-course does a really good job of going through there showing you what the assumptions, the check reversion cap rate increases per year as assumptions, economic vacancy on assumptions, that those were the things to check.

To make sure that the number at the end of the tailpipe comes out and it’s legit. Yeah. And I asked that question because my assumption is initially when you get started, you think that you get mesmerized by the numbers, whether it’s equity multiple or the IRR or whatever it may be. And then once you dig in a little bit, what I found is it seems to be more of a investigate the operator and think who you’re.

Who’s going to be the main person that’s going to be pulling this engine. Who’s going to be the main engine behind it. So that’s where I landed on, but I wasn’t sure if that was the main thing or if there’s anything else that I’m missing beyond that you’re going about this, you’re following the exact typical progression right now.

You’re realizing, you’re hearing all this terms of invest with the operator. Which is me, I guess it’s like the, I don’t know if that’s the best advice. But yeah. In one respect. It is true. You invest with the right operator, but you got to build up your own network to verify that third party wise, right?

Yeah. And people, I think a big mistake is people will interview the operators and I think that’s an incredible waste of time. They’re going to be able to tell these questions and answers in their seat. Sure. It doesn’t really do any syndicator can do this. Even the horrible one. What I do is yeah.

The, I go look at the numbers first. If they’re underwriting the deal the right way, then I waste my time and talk to the person. Sure. So if you’re able to get to a, I think you’re trying to get to that next layer, which is all right. I need to for the most part, know how to look at a pitch deck to spot check their assumptions.

If their assumptions are right, then I’ll continue forward and continue to stating process. Yeah. Yeah. Yeah. I think it’s one of those trusts was verify. The first part is just understanding that figure’s line liars figure, like you can make statistics say anything. So to your point, it’s, let’s figure out who the operator is, but then the next layer beyond that is how do I know that this operator is legit because everyone’s got a great story.

Everyone that you speak with is gonna have a a compelling value proposition, but that’s their job. So where do you go from there? How do you know that? From a, maybe another source for someone else, who’s in a similar situation as you, that the situation that you’re looking at, the operator that you’re looking at, that they’re legit and they’ve proven that.

Over time. That’s where I’m at right now. You can also, you gotta be also careful of like operator just got lucky from 2012 to 2014, where any idiot could have made money in Dallas. Now they’re getting really ballsy on their underwriting and they’re not even expanding their version cap rate for example.

And yeah. Yeah, they have, they got lucky with that track record or some people that felt for them, but their numbers. I wouldn’t confess, I’m not invested in them. Yeah, I thought that sponsor. Sure. And I think that was the modus operandi behind. I don’t know if that question is in here around. So when you’re looking at things from an underwriting standpoint, what are some of the, there’s so many things that you could look at, but what are some of the things that stand out for you?

Because it does come down to, okay. So how are you underwriting this particular opportunity? So for you, what’s what stands out. Yeah. So number one is reversion Capri. Number two is what are they using for rate increases per year? Number three is what are they using for economic vacancy? Those, I think that’s 70% of it right there.

I’m you spot check those three. Yep. Pretty good. From LPs perspective. I think you’re better than most of these at that point. Yeah. So you mentioned reversion cap rate, economic vacancy. What was the third one? What is the annual rent increases per year? What is the annual escalator? Okay. Got it. Better. Not be higher than two and a half percent to 2% sub-markets are getting crying, but some of these guys will be using three, three and a half percent, right?

Yeah. Yep. Yep. Okay. Your second question here. Example of a mentee success. I think a lot of people, I don’t really follow too many people in my group. I have about 400 and investors now that have been in deals. I don’t really track what they’re doing and then they come back. Yeah, but you guys don’t have enough dry powder to invest in every single deal.

All right. So they just get on a routine where they invest in one deal a year. So I with once a year, but the guys in the family office, Ohana mastermind, I see them pretty frequently every other week. So I think that’s why I tried people get people in there because the whole thing is like, deals is just one third or the picture you fixate on it right now.

But trust me, it’s just the beginning of this simple passive Castro gravy train. It allows you to get the passive losses. And then those passive losses allow you to implement different tax strategies to pay less taxes, maybe even real estate professional status, which may or may not be for you for a high paid professional that can seriously save a lot of money, way more than they’re going to get in any real estate deal.

And that allows them to save more money to invest. Yeah. Or unlocked other, higher end strategies like infinite banking get into the legal and other tax strategies from there. So unfortunately guess the deals is like how I kind of trick people into the mastermind because it’s the sexy thing to go after like returns.

But once they’re in, they start, the strategy becomes more holistic wealth planning with the taxes and the vehicle and the network. Yeah, where I’d read somewhere. I can’t remember if this was on a podcast you had mentioned or, and and one of the the resources that you had where you had made a comment around, Hey, in four to seven years, there’s a possibility for an individual to, really be able to sub supplant a significant portion of their income through passive investing.

And I was curious in terms of, little bit of back, even if it’s not a a specific individual, what are the strategies that they implemented? So day one, they come in, obviously you gotta have a certain amount of cash on hand. You just can’t be someone who’s broken is coming in saying, Hey, make me rich.

So typically speaking in order for someone in four to seven years, to be able to generate a good amount of that passive income. What do they, what do you think is a good start to come with? Typically speaking, how much on a yearly basis do you think they would invest? And then what are the, where do you see them?

Do you see them in 47 years? Gender and what kind of income? At the time in 17? The nice thing about this real estate stuff is you, aren’t going to strike out. It’s hard to do. The bad thing is you’re we’re not doubling our money every other year. Yeah. Oh, the performers are set that you double your money every five years.

Sure. That comes down to maybe a 15%, 60% of my are, or 20% on average on total returns. But your money is moving. But you got to get it in there. I think one mistake is like some investor comes in, invest in three deals and they’re like, why am I not the financial freedom? It’s dude, you only put in 150, 200.

Thousand dollars. What did you expect? Like the best thing that this thing can do is 20% a year, I do the math. That ain’t much, you got to put in enough, you got to put enough skin in the game for it to work. Which is typically, the model is to start to go into deals pretty frequently.

As soon as you can save up money in the ideal scenario is you’re in maybe two or three dozen deals. Yeah, 50 grand a piece and you’re invested a million million and a half at that point. Now you’re kicking off at 8%, at least, six figures a year for you to live off of. Yeah. But that requires you go into a serious amount of deals, not just dabbling in as you’re trying to see.

What’s what you want to do. What’s your million dollar 401k. Yeah. Cool. What would you do with 500 grand liquid today? What would your expectation be for the investment in five years? If you’re brand new to this, maybe just dabble with a few deals, like 150 grand, right? Three deals. See how that goes.

See if your operator steals your money. See if they’re competent. See if this is good for you. A lot of guys, they come into this and they’re neurotic. I can’t really tell what kind of personality is. That’s why I’m pretty upfront with you guys. And look, if you’re asking a question about something nitpicky on the P and L’s every other month, this is not for you go to Vanguard rank who bothered them should, they’d love to spend their time on the phone on investor relations.

But if you’re looking for folks to run your guys’ investments, prudently with pretty much low fees where you get most of the returns, this is the show. But I always liked the concept of, getting proof of concept first, then bringing in the majority or money, so I dunno if I wouldn’t, if you had to force my arm and you have to invest 500 grand, maybe throw it in a handful of deals at a hundred grand a piece, you don’t just get diversification again.

You’re trying to build up to this syndication ladder where they’re evenly spaced out over five years in a few dozen deals. That’s the goal. Yep. Any of the, more than that, I think you’ll go a little crazy. That’s a lot of K ones, but you start to lose track of who’s got your money. Okay. Number four here.

What’s a deal. You Greg, we’re getting not taking, I don’t know if there’s a deal. I, Greg, not taking. I do every deal. That makes sense. If it’s cash flowing day one, there’s enough buffer in there. And there’s a true story to raise the rents with a little bit of value. Add on it. Because that’s another good deal that I want to diversify over.

Yeah.

There’s like deals like we’re looking at one and I was like, seriously, a class D on Houston that ultimately the deal killer was like, The rents are already pushed. It was already 850 for unit. So we weren’t able to push the rents, but we’re getting such a good deal. And the and the buyer was so desperate to sell it.

They’re so distressed that they’re willing to carry back like $9 million of the loan. So I didn’t have to bring any money to close the deal. Yeah. It just seemed like a little bit too dangerous of a deal. But that just didn’t fit in my criteria. I could choose cash line day one, stabilized 90% occupied or more with the ability to bump the rents up a hundred bucks with a little bit of, that stick on a pig.

What was your criteria include D or maybe C at best and, hope for those B minus C plus. And higher, I would have done that deal if it wasn’t a little bit better area that was in the straight up D class area. There were murders like every week there. And if there was ability to bump the rents on that one, there wasn’t.

So if you get into trouble, you can’t really bring in extra capital bump that rents up cause already too high. Yup. Okay. I don’t know that. I don’t know. It’s hard to turn away from because the seller was like bringing in all the down payment for me. No money in, but it just didn’t fit the criteria.

Glad to hear you’re sticking with your guns. Number five, what is an example of a deal that you were involved in with sideways? What did you do? Yeah, a couple of them. One of ’em I had a bad partner. He turned out to be a shyster. I had to remove him from the general partnership, getting my LPs to do and that was where I changed things up a little bit in my strategy. I needed to be more involved and see when things like that happen and not just put complete trust in partners. This is why on the deals these days, I’m pretty involved on operations. And I need to know when things are going sideways or something out of the ordinary is happening just out of fudiciary to my passive investors.

And that’s the danger on these deals, right? It’s the assets. They run themselves if you right by the right deal. But it’s the people, right? The people, the operators, like kind of the biggest liability, biggest source of potential issues. Sure. Kinda like buying a nice car, cars. Not going to blow up where the wheels are going to fall off, but if your driver goes to sleep, yeah.

That’s the biggest risk. Yeah. On another deal on our actually a couple of other deals, we, one deal, it took a long time for the deal to close the S the buyer, let the property go. Didn’t fix up anything just didn’t care. So we inherited the property at a nice 50, 60% occupancy. Which isn’t the greatest.

We hired some consultants to help out lease up the property. And we got back up to 90% in a few months. So we brought that one back from the dead. Another one we had this both of those are class C all these higher class details, but the third case was property went down. Property was just the tenants.

Weren’t paying collection wise. They were paying majority, but. Know, the 20% is pretty much, it’s really bad for collections. And sometimes this happens in the first few months where, we’re just the new step-parents taking over and tenants try and challenge you. But yeah, I think it was like four or five months went by and we were just like, yeah, this isn’t gonna work.

We just gotta fire. These are evictees tenants. So that’s what we did. We purposely demolished and got rid of 20% of the tenants dropped their occupancy down from 85, 80% down to sixties. And then pretty unfortunate event happened. The city pulled all our section eight units, which are about 10% of the units, just because the previous seller was really buddy with the inspector.

So that dropped us to 50% occupancy, which is not fun. And that was about where we were like losing money. You always ask what is this, the sensitivity analysis? But on that one, I think that was back in, we dropped the tenants in November last year. And a year later, we are now up to 85%, what an adventure.

So we’ll probably refinance here in the next few months and then, catch up investors on performance. Probably even beat performer. I think a lot of the rehabs have been the good thing when tenants move out like that, and you have low occupancy as you can get in there and rehab the units.

Yeah. That’s why we raised the capital for the rehabs. So it’s independent, it’s a separate budget or operating account.

Yeah, overall, like out of 30 something deals like know maybe 10% of the time, something like that happens. So there’s not like we can’t come back from it. Yeah, but it’s the one, it’s the one that stings is the one where you have a bad person. That’s when it’s hard and yeah, luckily it was the only deal I did with that person.

What is X number six, w from an underwriting standpoint, what is at the top of your list and what numbers you assume? We talked about that. I would check out the. Syndication e-course for that. And then in that e-course, there’s also LP checklists, Excel spreadsheet with a whole bunch of questions you can ask.

I wouldn’t recommend asking all the questions because you can get a little annoying, I think, to the sponsor, but I think just things for you to be aware of, make you think of it. Yeah. Number seven, where would you not invest that other syndicators are investing in geographic and asset type? Things like primary markets where there’s no cashflow when rent to value ratios where it doesn’t make sense. Not to say you can’t make money doing that. You make money by increasing the NOI, but just my criteria.

I want to cashflow day one, types of assets. Office space. I actually like office space. You saw that last deal. We did that tax and bill tower. We bought that for 70 something million 75, 76, and we got it appraised the next week for 81. Yeah. But every deal is different.

But if there was one general cast of, I don’t like retail, like storefront, like shopping malls. I don’t like that. W what about deals in the Midwest? So it seems like more and more folks are gravitating toward the South or the Southeast. Back when I was looking at turnkeys, it seemed let’s say, HIO there are a number of different places that have a pretty good, you were talking about the rent Value ratio that are 1% or above, would you go into in the Midwest where there’s a cold type of an environment, snow, et cetera, or?

No. Or it depends on the deal. Sure. If it, if I use the right deal assumptions, right? So for a de Moines, Iowa, instead of a 2% rent increase per year, I might use a half a percent or 1%, like I’m able to tweak my. My spreadsheet to account for these types of things. So I’ll never say never.

But yeah, and it’s also gotta be more like sub-market based. So just blanket saying like Kansas city, Missouri, or. No. I want to talk about Oh, where is this property? Overland park, Kansas, or right. Or wherever, like I want to dig in. So I don’t want to, that’s where I would dig in a little bit more, but I wouldn’t necessarily say it’s like a no, no bueno generally pop increasing population areas.

Ohio’s kind of a flat line in terms of population. Yeah. I invested in Birmingham. I still have a lot of my incubator stands, go to Birmingham. It is a flatline population. Similarly, I can say it’s declining in a way, but if you invest in the right areas and invest the right people, I think you’re fine.

It’s all on. Not like sub market is more pointed, but also block the block too. So strictly from an economic standpoint, whether it’s population growth, rent, growth, et cetera, obviously you got, it depends on the keel that you’re getting. What are maybe three cities that pop out at you where you think, man, that’s an amazing city.

If I could get the right deal, I’d go into is it, I dunno, Houston or Orlando or. Oh, it doesn’t. I don’t think I wouldn’t. I would try not to answer it question, because again, it doesn’t matter. It’s more as long as you’re in like a halfway decent city, the key here that a lot of investors don’t realize it’s your broker relationships, their deals coming up all the time that transcend can be in freaking Bozeman, Montana.

But that broker is working his butt off to get that deal, extract that deal from that desperate seller or that motivated seller. And those are the deals that we’re pulling the trigger on. Yeah.

That’s supersedes. If it’s like that great of a deal, I’ll go anywhere. I don’t care. Yeah. Where meaning if all was equal. So yeah. Cool. Is there a particular geography or maybe I’ll reword your question? I’m going to reword it and say, Hey man, I like these Houston deals. I like these Huntsville deals you’re at.

But if you were recommending any other city that you’d like to diversify, because I would like to diversify my acute, my profile geographically, where should I go? I like Phoenix, right? That’s it’s more of a up and down market, but it can, it’s been growing like crazy Landoll that Carolina, Atlanta, I think Dallas is a little overheated these days. You can make anything work there, but let me see Nashville. Yeah. Yeah. Nashville is a little expensive, but I think you could make like a we’re looking like Tuscaloosa, Alabama, and you guys, I just want to go see the roll type plate.

Person that their place? Tallahassee, no, not Tallahassee. I’m liking on like Tuscaloosa and in Nashville, somewhere in Nashville or somewhere in Tennessee, but I’m liking not the city. It’s one of those like more tertiary markets, but yeah, that’s what I’m personally looking at a little bit.

But mostly because I have the property management connection to that area and the broker relationships, not necessarily because they’re like the best places. Cause I think it doesn’t matter, but again, where the question is coming from, you’re trying to diversify. Yeah.

If you could roll back time, what would you do different in your investing career? Some people say you shouldn’t have bought those 11 rentals. Yeah, maybe I shouldn’t have, but that was key for me to getting above half a million dollar network, because I don’t think if you’re under that, you should have no business investing in syndications, but let’s say you do have a half, a million dollars worth of your cash or ability to invest.

If you already have that. There really would have been no point for you to go into single family. You learn a lot, right? Like most investors that are accredited, they just come right into syndications, but they have a huge hole in their understanding of the stuff. Yeah. And I can see it. So I assigned for the learning.

So certainly single family is a great place to get your feet wet and get an appreciation of real estate. And just some of the terminology, how things work. If you preclude that, not counting that if you’ve got the 500,000, then there’s, I’m trying to think of what the value proposition would be of going into single family.

If knowledge is not an issue. And if cash on hand is not an issue, they’re really well educated. Education is a big thing, but I think to me, the holistic way of building of your net worth is to build your network. And unless you’re just, you don’t have any experience, you can’t walk stories at the bar with other accredited investors, everybody is a rich guy with no experience. You’re not going to set yourself apart. You’re not going to be a value, add to another person. Yeah. Add some experience of, in the trenches being a landlord, owning some rentals. Okay. Sorry. That’s what helps having some bad rental properties is some of the best stuff that talk about that relationship.

Oh yeah, of course. The key is getting in the right rooms, with the right pure passive approach to investors.

if you could roll back time, I wouldn’t invest in my retirement account. That’s a waste of time. I want my money out. I want to pay my taxes now. And I wouldn’t pay down my debt. That’s good debt. What makes me different from other syndicators? I don’t know. I’m just trying to like, try to be transparent.

So what assumptions we’re making and if you guys want it and you guys can join us. I don’t know. I just see a whole bunch of people, just a bunch of smoke and mirrors and marketing and a lot of groups out there. And I think they attract the wrong people. They attract really annoying investors. I just want good hardworking folks that know that there’s a little bit of a bumpy ride, but maybe you diversify or get there and just be good stewards of their money.

That’s my vision know everybody to more petite or I can see people get to FY status beyond and see what else they do. And maybe they might want to stick around. That’s what the family office Honda mastermind is all about. People stick around after the first year and help out the next guy, because relationships is the currency of the rich, every scenario looks great on paper.

What would your advice be for new LPs? What type of syndication would you be cautious about? I would go into more stabilized assets in the beginning and get the cash flow. At least know your sponsor’s competent enough to set up direct deposit. Granted a lot of people raised extra money to pay out investors like a Ponzi scheme.

You gotta be careful with that, but, I think that’s a great way of getting started. You don’t need to go after like the luxury development off the bat. I don’t think those typically aren’t good deals because they typically attract on sophisticated credit anyway. Yeah. But. Get into some deals so that you can just, you can show that to other passive investors that you got some money in the game,

Any other questions or wrap up? No I think that’s it, man. Like I said, very helpful. Appreciate your being open and taking the time to touch base and. Talk about some of these things very helpful or.

Investor FAQs

What deals do you currently have open?

You can check out our investor portal to view our current offerings, when a new deal is offered we will announce it via email.

What Types of Deals Are Offered?

To try and explain which type of deal is for you, please read on!

There are three flavors of soft serve (ice cream):

1) Vanilla  – Thrive/Canopy this is your standard stabilized deal with some cash flow and a small lift on rents to do the value add. It takes a while (4-6 years) but it’s well and safe should a recession come.

– Thrive/Canopy this is your standard stabilized deal with some cash flow and a small lift on rents to do the value add. It takes a while (4-6 years) but it’s well and safe should a recession come.

2) Swirl (vanilla/chocolate)

3) Chocolate

As stated earlier, newer investors will want to go for cash flow (vanilla), but after gaining some experience with a couple of deals when you see the deals dump out the retained equity in big chunks you might say “well crap, maybe I should have gone for the chocolate or swirl and made more money faster.” All in the positive progression of a passive investor

Those under 1M-2M net worth, think in terms of monthly (example all of the new and scared investors ask if pref equity is monthly because they need that monthly income for peace of mind), but higher net worth or Family Office money think in terms of quarterly, annually, or longer.

On the surface, the vanilla is the “safer” deal, but in reality, the safer play could be the unique deal whether it was Chocolate or swirl and had a special aspect like a heavy loss to lease play, hedged with a great submarket or a development project, where you are building it at 60% of the sale price (ie development).

Another idea is looking at each deal with the lens “what is the worse that can happen here.” The more perceived risk you take on the more potential returns or cone possibilities.

Pref vs Traditional Equity (Choosing an Investor Class):

Below are videos discussing pref-equity vs traditional equity classes:

1) https://youtu.be/Ozc3bQhMXDU

2) https://youtu.be/mS1ZwHxTaIA

3) https://youtu.be/nwWhXeCoiLg

We originally had the traditional equity (A2) option when we started to do deals.. It was very simple just one option and operated very similarly to most equity based deals out there.. Later we realized that a small minority of investors might like the deal (asset/location/business plan) but they might want a more conservative option with a shorter time horizon and not want the upside. Pref Equity (A1) was born which acts like a debt investment where you get a fixed rate of return with no upside (equity split) but often times get paid first and get to exit first.. Every situation is different but this might be ideal for

1) Mature investors with higher net worth (over $4m) who just wants to collect a steady income check or

2) New investors looking to move away from ordinary income private money lending or they need to show a skeptic spouse or themself that this alternative asset investing world is real..

3) A hybrid investor that wants to create some piece of mind with a steady income stream (some investors have takes HELOCs or home equity and want to put it to work in a less risky endeavor)

More general info is found in Section 2 of the Syndication eCourse

What Are Our Investment Goals?

There are three goals of our projects in this respective order

1) Capital preservation (don’t lose money)

2) End goal business plan of bumping NOI to achieve the higher price at sale in 5 years

3) Cashflow. When things go great you never hear anything and that is what we like but in some cases we have to triage our management decisions based on the constraints in that order.

When Do I Receive My First Distribution?:

After closing the asset goes through a restabilization period. The restabilization period varies between deals due to the time it takes to complete value add work like unit renovation/amenity/facility upgrades and transitioning our property management for operational improvements (rent increases/enforcing proper rent collection)

Pref Equity – Your pref equity starts accumulating after the asset is closed. Pref payments typically start a couple of months after the deal closes

Traditional Equity – First distribution is 1-2 quarters (typically 6 months after a deal closes)

When Will I Receive my K1? (Tax Document):

K1 docs are targeted to be sent out by mid to late March. We receive all final bills/late rent checks and cost seg information by late February and rush our document to our 3rd party tax team who need at least 2 weeks to complete the K1s.

With that said, most investors always extend to file taxes in October. In fact, only an extension form is really due on April 15 whereas the 1040 forms are truly due in October. There is really no good reason to file in April when everyone else does it because by extending you 1) allow your personal tax return preparer a longer timeline for proper completion for better quality, 2) you can see the latest changes in the tax code unfold through the summer which might allow you to make changes in your tax strategy (S Corp split optimization, retirement fund allocation), 3) plus some think that giving the IRS six fewer months to audit your file is prudent too.

What are the Steps to Invest?

Here is an outline of the steps below:

1) Create an account in the investor portal

2) Fill out an investment commitment and sign the investor documents

3) Wire your funds and mark that you have done so in the portal so it will alert us that you have done so.

Do I Receive a Wire Confirmation When I Fund?

Once your funds arrive it will take an additional 1-2 business days to settle into account (where someone can actually view the wire details like who sent it and how much was sent). Once the funds settle, we will mark funds received in the login portal. You will receive an email from our team confirming your wire was received. In addition, you can check in your portal to check that it was confirmed.

*If you do not see that notification email or your portal does not show the wire received please email us 3 days after wiring

Do I need to be accredited to invest?

No, since our deals are currently 506b, we can take a certain amount of non accredited investors on each deal.

How Can I View My Investment?:

The portals can be confusing. Here is a summary of uses:

Truepoint.investnext.com – Huntsville/Houston deals – Note this is the portal for changing your address, direct deposit ACH info, K1s, and distribution info.

hui.invportal.com/login – Arizona deals – Note this is the portal for changing your address, direct deposit ACH info, K1s, and distribution info.

Members.simplepassivecashflow.com is the portal for new deals, educational content, and living log pages for the deals you are in. We created a duplicate repository incase you are like most people who might miss a few emails here or there you can go to your deal and catch up on the past few months of updates.

How Do I Keep Up to Date With My Investments?

Each deal will have a monthly report updating you on the pertinent information as well as financials. The monthly update will be on the deal page and emailed to investors.

In addition to the monthly reports, Lane answers questions about current deals on a quarterly basis during his ‘Open the Kimono’ webinar so you can get an understanding of each deals status.

Who Do I Reach Out to for Investor Support?

For Investor Relations requests please send us an email at team@simplepassivecashflow.com since we don’t want to lose track of your request and so we can route your request to the right team member.

If you have a specific question about a deal please email chad@simplepassivecashflwo.com

FAQs

We have prepared this document to help address commonly asked questions. Some questions might pertain to more general inquiries and other are to more specific offerings for example development deals as opposed to stabilized/value-add projects. Please consult the PPM and feel free to ask questions to aid in your full understanding. If you need any help don’t hesitate to reach out to team@simplepassivecashflow.com or give us a call 808-215-5531.

What is the minimum investment?

In most cases we set our minimums range from $50,000-$75,000. In larger deals to minimize admin costs and investor count we will increase to over $100,000. We try to minimize investors in one deal to under 130-160 investors.

Will there be capital calls?

We do not anticipate making capital calls and to date we have not had any. In the past should the deals not meet expectations we as General Partners have delayed taking compensation in order to put passive investors first. In rare cases, General Partners have infused personal capital. This is why we like stabilized assets that cashflow because capital preservation (not losing money) is prioritized. In addition, we always carry adequate insurance, cash reserves, and working capital which is often mandated on the conservative side by our strict lenders (bank). Should additional capital be needed, we retain the rights to do so in the subscription agreement. Please refer to these legal documents for more details.

Can I invest with my retirement account? Self-directed IRA, Solo 401k, etc.?

Yes. As long as your retirement funds are in an account that allows for your investment discretion, i.e. Self-directed IRA, we can accept these investments. If you need a SDIRA or QRP custodian that other investors use please let us know.

Can I increase my commitment throughout the fund?

There are two types of syndication arrangements. 1) Blind pool funds which has multiple assets and might allow for multiple loads into the deal. 2) Single asset (or pre-determined asset deals) which operate like a single load and since exit transaction. Up until we close the asset we are flexible to increase your investment.

What is the difference between the Class A and B shares or A1/A2/A3?

Below are videos discussing pref-equity vs traditional equity classes:

1) https://youtu.be/Ozc3bQhMXDU

2) https://youtu.be/mS1ZwHxTaIA

3) https://youtu.be/nwWhXeCoiLg

More general info is found in Section 2 of the Syndication eCourse (see also “Past Q&A from older deals regarding Pref Equity (A1)”)

When will distributions begin and how frequently will they be paid out?

In most deal we advise investors that distributions are anticipated to be paid after the completion of the second quarter in order for us to re-stabilize the asset after take over because the bank (lender) does not allow us to pay out until KPIs are met. Other operators might pay out the first month or quarter but in those cases extra capital is raised to pay back investors which we feel is a Ponzi scheme and not a best practice in order to utilize cash reserves.

This and many other things to look our for LPs are found in the Syndication LP eCourse.

Once there is a refinance am I diluted out?

Of course check the Operating Agreement of the offering but we have always tried to build our splits that align ourselves with passive investors without complicated waterfalls and tiers. In most cases, investors remain in the deal even after refinances (return of capital) all the way till the asset is exited.

Many other splits are explained for academic purposes in the Syndication LP eCourse.

What type of reporting will I receive?

You will receive monthly email updates by the 20-25th of each month (normally it takes a couple weeks for most of late rent checks and vendor invoices to roll in). That report contains financials (P&L and Balance Sheet) as well as the rent roll, and trend graphs for various key metrics (like income, expenses, and NOI). And most importantly, it’ll contain a narrative of what happened the previous month so you always know what’s going on. You will receive a K-1 anticipated to be provided by March 31st of each year.

Samples:

- Fort Worth, TX – Class C 168-Unit (130% in 3.3 years, 40% per year or 50% IRR)

- San Antonio, TX – Class B 192-Unit (92% ROI in 3.5 Years! 18%+ IRR)

- Huntsville, AL – Class-C 44-Unit (34% in 3.5 years)

- Atlanta GA – Class-C 114-Unit (134%+ in 2.5 Years)

- Huntsville, AL – Class-C 70-Unit (108% in 3 years)

- Huntsville, AL – Class-C 49-Unit (26% in 2 years)

What is my liability as an investor?

Investors are coming in as limited partners. Limited Partners liability generally will not exceed (1) the amount of its Capital Contributions, (2) its share of any assets and undistributed profits of the Partnership, (3) its obligation to make other payments expressly provided for in the Limited Partnership Agreement, and (4) the amount of any distributions wrongfully distributed to it. In addition debt is not placed into the passive investors name, instead it is in the General Partners name.

How are taxes treated?

We are not a tax advisors and we recommend you reach out to your tax advisor to understand the effects for you. You will receive a single federal K-1 and a single state K-1 for each income tax state we own assets in. We will be preparing composite tax returns for those states that require tax filings on behalf of all out-of-state investors, relative to the respective states.

Will I be able to get my money out before you sell all the assets?

Your investment will be considered an illiquid investment, so anticipate that your capital will be committed throughout the life of the deal. However, we will be distributing proceeds from refinances as soon as possible to get your original capital back to you so you can reinvest it. In some cases, a private sale can be made (we do not advise either party as to price, terms, etc and you are responsible for arranging the deal between you and the buyer) but please understand the illiquid-ness of this investment. Most investors are Accredited (however non-accredited sophisticated investors are accepted on a case by case basis) and it is expected that should you have a financial hardship that you would not look to liquidate this position – in order words you should have other places to get money from (like your infinite banking).

Can I 1031 exchange my investment?

Below is a summary of 1031s. But with the amount of bonus depreciation in deals going to LPs I don’t know why people do 1031s???

In 2018 I sold 7 sfhs and had 200k of capital gains. I just offset it with 200k of passive losses that I built up by going into syndications.

The 1031 exchange is a method of pushing forward the taxes due on the capital gains of a property. You have 45 days to identify replacement property that 180 to close on said property(s).

Its a way of kicking the can down the road with taxes. I personally that you have to pay taxes at some point unless you are going to take it to the grave with you which is not very practical due to the following.

1) The 45 days is almost impossible to execute. To be able to line up a deal that is “hot”. Experienced investors spend an average of 18 months to find that elusive first apartment. Now if you are buying lukewarm deals… then be my guest. But in this seller’s market, I think its a way to lose everything.

2) Most investors that I work with are high net worth and able to cashflow income minus expenses over $30k a year and have over 50K of liquidity on hand. I believe that most people, unless they are talented at being an elite investor, should just be an LP role in a syndication due to the scalability and being able to spread their capital across different leads, business plans, asset classes, and geographical locations. That said a 1031 exchange will not allow you from going from real property to an LLC (ownership in a syndication). Although you could do what is called a Tenant-In-Common (TIC) arrangement where an investor has 1031 exchange funds and wants to parlay that money into a syndication. It’s possible but from the syndicator’s perspective a lot of unneeded work when you can just raise the funds the traditional way. Caveat: if you are bringing in a huge amount of money say 50% of the raise then that might tip the scales in your favor). We would do a TIC with you but you would need to bring in more than 1-2Mfor it to make it worth the administrative burden.

Again when we sell the asset in 5-10 years anyway you will be in the same but worse predicament. Take advantage of bonus depreciation now.

There are reverse exchanges and other more exotic exchanges but I personally not sold on the concept when the IRS comes knocking. I am not a tax professional but I feel it is tax evasion.

As a LP investor in syndications deals large enough to pay a guy 5-10K we do cost segregation in order to get bonus depreciation and write off a huge portion of the taxes from exiting the last deal. Basically bones depreciation has made 1031s obsolete.

The order in which suspended losses are deducted is:

1. To first offset depreciation recapture and gain from the activity that was sold.

2. If the suspended losses are in excess of the total gain, the remaining suspended losses will then offset ordinary income.

3. If the suspended losses do not offset 100% of the gain from the activity that was sold, you may use suspended losses from other rental activities to offset the remainder of the gain from sale.

This is detailed in IRC Sec. 469(g)(1)(A). And if you want to have a wild Wednesday night, here’s an article that explains it in-depth:

https://www.thetaxadviser.com/issues/2008/may/disposingofanactivitytoreleasesuspendedpassivelosses.html

Question about the PPM:

“The Offering is not underwritten and is being offered on a “best efforts” basis by the Company through its managers and officers.”

I don’t believe I’ve seen language like this in a PPM before. What does this mean? Doesn’t the bank do underwriting for the loan?

Also watching your lessons learned video, I am wondering if you have any operating procedures in place to try to catch issues, like large/unusual expenditures, etc? I know you have worked with Kyle a lot and have a lot of trust there, but just curious.

Also watching your lessons learned video, I am wondering if you have any operating procedures in place to try to catch issues, like large/unusual expenditures, etc?

How do I get started if I want to invest with you?

All of our investments require that we have a pre-existing relationship with you. That’s why we have you complete a questionnaire and schedule a Video/phone call with us. Plus, we want you to be 100% comfortable with investing with us, get to know us better and get all of your questions answered because once you invest you join a roster of over 700 live investors (as of 9/2021).

Do I need to be an accredited investor? What determines if you are accredited?

No, but we are limited to a certain number of non-accredited investors, so if it’s an advantage if you are one.

An accredited investor is someone who meets certain requirements regarding income and net worth, based on Securities and Exchange Commission (SEC) regulations. This is so that the SEC can ensure proper protection for all investors.

To be an accredited investor, you must satisfy at least one of the following:

- Have an annual income of $200,000, or $300,000 for joint income, for each of the last two years, with expectations of earning the same or higher income this year.

- Have a net worth exceeding $1 million, not counting your primary home

How do I get notified when you have an investment opportunity?

You’ll receive an email from us about an upcoming deal; typically we’ll have a webinar with more information about the opportunity. If you have further questions, you can reach out to us and schedule a call please use this link. If you’re interested in investing, you would log into our investment portal and let us know how much you’d like to invest though the soft reserve request form on the corresponding deal page on Members.simplepassivecashflow.com/

Then you’ll have a chance to review the legal documents and sign them via Docusign. Once that’s done, you’ll get the wire instructions and wire the funds to the closing attorney.

Then you just wait until we close!

When do I usually start getting paid after I invest?

This varies by project. Distributions are made quarterly if not monthly for pre equity positions.

We utilize a secure payment portal where you can specify check or ACH transfer. We highly suggest utilizing ACH as it quicker and better traceability. A lot of these admin changes such as direct deposit or address changes can be made in our self service portal.

How often do you have a deal?

Our goal is to provide you with an investment opportunity 4-5 times per year.

Yes.

In rare occasions we have invested in Opportunity Zones however one of our criteria for deals is investing in solid locations. Sure there might be good tax benefits for investing in a certain area however we don’t “let the tax tail wag the dog.”

When and how do you make the decision to refinance or sell a property?

We constantly evaluate the markets in which we operate to determine when it’s best to refinance or sell. The five-year timeline is representative of what we expect but rarely on what will happen. If market conditions change, we will make the appropriate decision at that time which may cause our hold period to be shorter or longer than the initial business plan intended.

In the past, we did a lot of class C assets which are in rougher areas and difficult tenants. These types of deals line up to a more “pump and dump” in year 2-4 strategy. Lately we have been going into larger more institutional assets in better areas so they line up to be more 4-7+ year holds with ideally a refinance at year 2-3 to pull out as much original capital. We love cashflow so in most cases should an area still provide growth opportunity we will switch for a long term hold strategy.

In the end we aim to grow investors capital as best as we can but emphasis on safety of our investment.

Real Investor Questions from Old Deals

I was surprised that the Q2 distribution dipped by 16% compared to Q1 ($1351.52 Q2 vs. $1604.94 Q1), is this expected? Are we on track to achieve year 1 cash on cash return?

Whispering Oaks is still getting out of the gates at this point however we are off to a good start.

We will likely be closer after the first year with cashflow to projections but projections are always a bit of a guessing game and we tend to be a little conservative paying out in order to hold for more reserves or pushing on projects at the property.

In some cases, we can take over a property and people don’t move out. This is ok for cashflow but slows down the total project. As the saying goes things have to get worse (or in these types of deals, occupancy drops temporarily 0-10%) before we can get into that initial bunch of units and bump the rents. Its not an incredibly complicated business but it is a fluid thing similar to a long train with a bunch of slack in the system that can take 1-3 months to work out a small hiccup like 2-5 tenants moving out unexpectedly.

Most of the value/returns in these deals are made by the force appreciation that unfortunately does not really come out until capital events such as and sales or refinances… on that NOI improvement front we are progressing well.

There are three goals of our projects in this respective order 1) capital preservation (don’t lose money), 2) end goal business plan of bumping NOI to achieve the higher price at sale in 5 years, 3) cashflow. When things go great you never hear anything and that is what we like but in some cases we have to triage our management decisions based on the constraints in that order.

Disclaimer: Lane Kawaoka is not an investment adviser or a broker-dealer registered with the U.S. Securities and Exchange Commission. The information in this FAQ should not be used as the sole basis of any investment decisions, nor is it intended to be used as advice with respect to the advisability of investing in, purchasing or selling securities, nor should it be construed as advice designed to meet the investment needs of any particular person or entity or any specific investment situation. None of the information contained herein constitutes legal, accounting or tax advice or individually tailored investment advice. The reader assumes responsibility for conducting his/her own due diligence and assumes full responsibility of any investment decisions.