Start Here

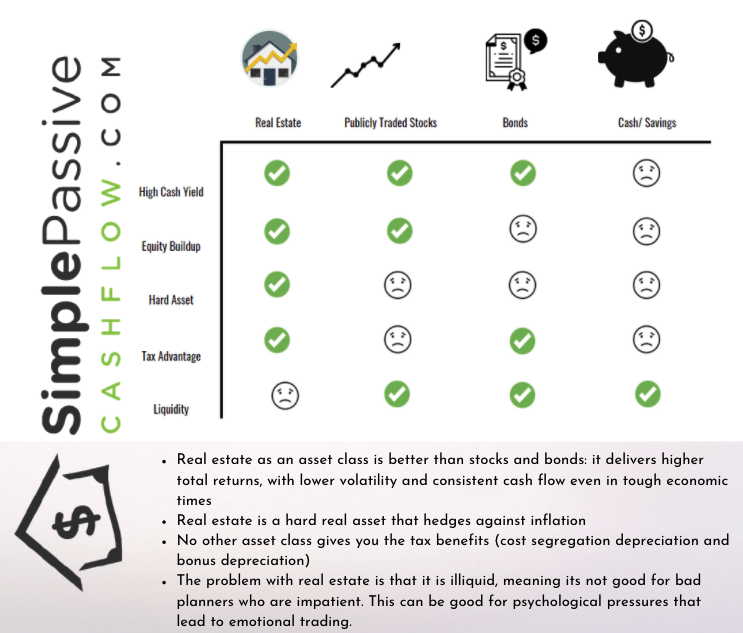

Why Cashflowing Real Estate?

Get to Know Me

When I was working as a construction supervisor I quickly became aware of the Cross-Over Point 2.0 below.

Learn more about me here.

Make Sure You’re Receiving the Latest News! 📰

Add “Lane@SimplePassiveCashflow.com” to your contacts list.

-

Gmail Users

Move us to your primary inbox

- On your phone? Hit the 3 dots at the top right corner, click "Move to" then "Primary"

- On Desktop? Back out of this email then drag and drop this email into the "Primary" tab near the top left of your screen

-

Apple Mail Users

Back out of this email then drag and drop this email into the "Primary" tab near the top left of your screen

For everyone else – follow these instructions

When you’re done, click here to let me know, so I don’t have to follow up with you.

If you would like me to send you deals that I am investing in please sign up here and then use this link to set up a time to chat so we can start building a relationship (and I get it most people are shy and say “why would Lane want to talk with me?”

Once you join the club I would like to get to know you a bit and see what you are working on so I can see if I can help you 😁

Starting this podcast in 2016 has been an amazing way to meet like-minded people and meet a lot of new friends.

Looking forward to getting to know you better and one day seeing you join our inner circle in our Mastermind!

Ask Me a Question!

Shoot me back a few questions you have I can answer on a future “Ask-Lane” Podcast. Submit a question here.

My Advice to New Investors

- Do not invest until you have been learning for at least 6 months.

- Do not deploy more than 200k in the first year if your net-worth is under 1-2M.

- Only invest after finding 2-3 good personal relationships of peer investors (not marketers, syndicators, or salespeople).

Admin Note: If you haven’t already, please take a moment and add my email address to your approved sender’s list, so you don’t miss any important communication from me!

You can do this by adding me to your contact address book in your email browser.

Click Here after you added me to your contact, so I don’t have to follow up manually. Still, don’t know how to “safe list” this email check out this tutorial.

Those who do not open emails are typically removed from our future newsletters and educational emails. So please stay engaged or let me know how I can make these emails more valuable to you.

Disclaimer: You might find our approach non-traditional how we look at using prudent debt as a tool, but it allowed me to quit my engineering job in 2019 after 12 years of working for the man. Here is a Forbes article I wrote that outlines the most common mistake I see with even experienced investors. Here are a bit more details on my website. Friends don’t let friends invest with lazy equity making a low return on equity.