Huntsville Deal

Below is a sample of a recent report on our Huntsville 407-Unit Portfolio deal. Each month we create an investor brief and a short video going over some of the highlights especially in the first year as we re-stabilize the property during the early takeover.

If you are new to investing or net worth under 250k consider the:

Sophisticated and Accredited Investors check out what is going on in our:

An onboarding call is required (I appreciate those referrals to friends and family!) as we run off a relationship-driven community.

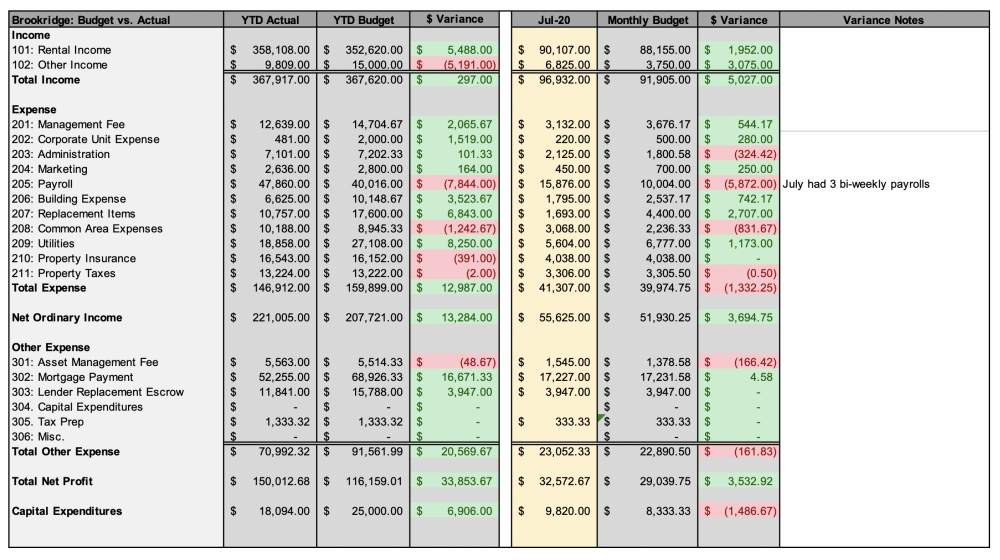

Brookridge:

- Starting occ/leased: 100%/100%

- Ending occ/leased: 100%/100%

- Renovated units: 38/171 units

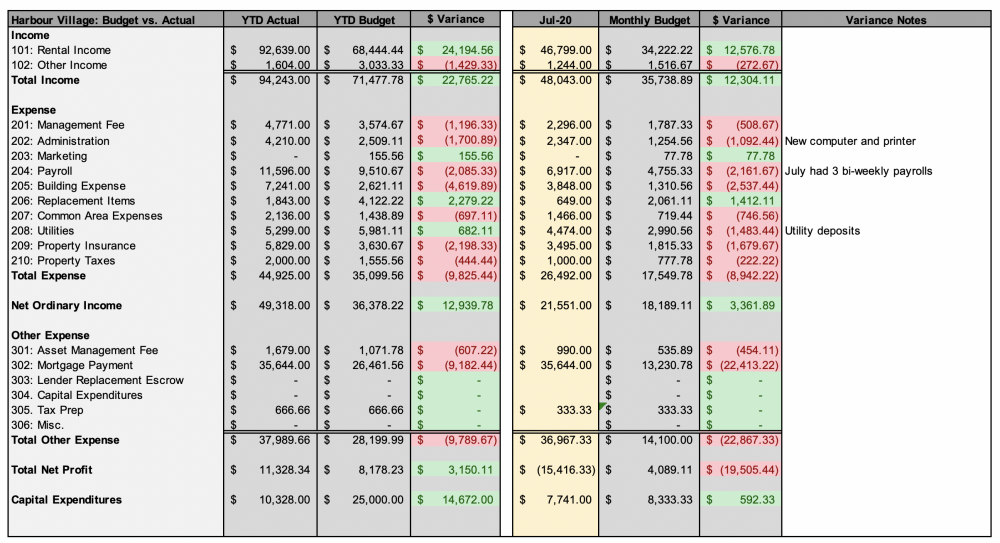

Harbour Village Investor:

- Starting occ/leased: 98.25%/98.25%

- Ending occ/leased: 98.83%/98.83%

- Fully Renovated units: 7/100 units

We are negotiating a price reduction with Imperial Gardens estimated to close mid September.

First distributions to on Brookridge coming out in September. And Harbor Village distributions to shortly follow shortly as we near our 6th month of ownership.

TRANSCRIPTION:

Unknown Speaker 0:01

Hello Huntsville, repack investors. We are going to go over the brokerage report here first we’re sitting at a pretty healthy 98% occupied released up to 100%. Six, it’s exactly where we want to be partially renovated units, we made a new category here for fully renovated, we stepped into this property with 36 out of 171 units partially renovated not by us but previously, but we are obviously taking it the full way. So we made another category here for fully renovated units, which we are three as of now. But Kyle, what’s, um, maybe give us a little bit of what’s been happening and some high points and low points.

Unknown Speaker 0:45

Yeah, so, um,

Unknown Speaker 0:49

income is up and collections are, you know, they’re continuing to trend Well, so, you know, just even based on those three units that we fully renovated, we’re getting you to know, 100 225 $5 premiums on those three units. And then also just on new renovations, because, you know, occasionally we’ll get as we’re going through a transition, we might have a couple of units that we can just that already have been partially renovated, some. And it may just make more sense to go ahead and get somebody back in there, just do a quick clean and turn and get it back up. So we don’t do a full renovation in that regard. But even when we do that, we’re still getting you to know, 50 to $75. Rent bumps from where they are today. So it’s just a little taste of what’s going on in the market. I mean, this property was still under market on rents. And so you know, we feel like there’s there’s some good room there some good headway, so. Yeah, and then just overall, you see that we are, for the most part, you know, we’re mainly expenses pretty well were coming in pretty far under budget on a lot of these big items. So that’s always good, you know when income is up and expenses are, what they what we thought that they were, that’s, that’s a good place to be in. So that’s how we’re able to put back the cash that we show here. So

Unknown Speaker 2:22

last month I think we put 28 grand or so in the bank this month, we’re putting 30 grand in the month so we’re stacking it up and pretty close to paying off distributions in May what you always like to line up all the quarters all together at some point. So that’s, that’s why we’re sometimes a month or two off but September I think is the month. We’re saying the

Unknown Speaker 2:47

the month just to keep it even. It makes it a lot easier to track distributions that way from our side rather than going ahead and kicking it off in the middle of a quarter but and With the class of one investor, you know that distribution is coming. So be on the lookout for that shortly. But that’ll kick-off, we will send a distribution at this point that we you know, we’re mid-July when we’re recording this. So it’ll be the first one that will be sent out this month for June. And then we’ll send another one here and a couple of weeks at the end of July for July.

Unknown Speaker 3:25

So again, that is for the private equity investors.

Unknown Speaker 3:29

That’s correct. That is not for the regular equity.

Unknown Speaker 3:33

However, we have 90 over 100 investors on this and there are always three guys or five guys who ask that, just like every hundred units, you have three guys who don’t pay right 97% collection.

Unknown Speaker 3:46

Exactly.

Unknown Speaker 3:50

Yeah, yeah. This is not at 20.

Unknown Speaker 3:53

So moving on to harbor Village. This is one that was a little bit of a lot of good news. On this one. Yeah, we are 98% occupied and went through seven units now. But um, yeah, tell us the good news on this. And folks haven’t heard about it.

Unknown Speaker 4:11

Yeah, really good news. I mean, I know you sent an email out to everybody. Um, we kind of talked about it, but we’re still continuing to get those $200 premiums. So, you know, again, we kind of knew this going into it, that we would have a potential to get those types of premiums on this property, but it’s actually working and coming to fruition. So, right now, for the remaining year, we had a monthly budget of about, you know, 30 35,000 on our income, and which I think actually, there’s probably an adjustment to be made there. So I’ll look at that closer. But I mean, the really, I think we’re going to continue to see that go up, but each unit we turn and so right now we’ve got about four Bacon’s that we’re in the process of as well. So we’ll have that number continue to go up? And, you know, I think it’s just a, an example of, you know, the type of market that we’re in the type of property that we have. It’s just a really good situation here.

Unknown Speaker 5:16

I mean, we try and underwrite conservatively on this, but you know, it’s always nice to get lucky too. So that’s nice to have the trade winds behind me. Yeah. And then we were off. We’re out what couple of weeks ago at these properties. So I’m putting together a video for you guys and we had a lot of footage of harbor village and kind of walking around with our maintenance stuff there for you guys. So I should get that out this next month. send it off to you guys. But if you guys haven’t heard, we are also kicking off the chase Creek development projects look into almost tripled people’s money in six years. So yeah, you guys are seeing The power of Huntsville right now with these two projects, but to wrap things up Kyle let’s um let’s get people the latest song.

Unknown Speaker 0:00

Okay, yeah. So to close this out, Kyle, what’s the latest on the Imperial gardens closing? No, we had some environmental checks there at the end. But just to give people a timeline on expectations there.

Unknown Speaker 0:15

Yeah.

Unknown Speaker 0:17

So we should have the results back.

Unknown Speaker 0:22

I’m looking at my calendar, it’s gonna be

Unknown Speaker 0:26

like the first, like the 27th or 28th of July is what we’re anticipating to get those results back. So then we’ll know what we’re looking at, if anything, how much you know, things like that. And so after a couple of days, if, you know if there is anything that we need to be aware of, you know, we’ll spend a couple of days trying to come up with a cost or anything like that, that the seller can make a concession on and so ideally, we’re looking at you know, we’ve got to learn They’re lined up already. So, you know, probably mid to late August, at this point

Unknown Speaker 1:07

is when we’re

Unknown Speaker 1:09

now targeting So,

Unknown Speaker 1:10

yeah, so maybe by the time we do this report next month we should be almost sent to the lock and ready five days to close kind of more or give a good indication. It’s alright, but yeah, if you guys have any more questions, feel free to send it on over we’ll get it on the next report. But so far so good.

Unknown Speaker 1:32

Sounds good.

Below is a summary of our Budget vs. Actual variance for the month: