How to Pay 4% in Taxes

Offsetting Your Active Income

Now that I left the W2 Engineering job behind, I can check the box on my taxes that I am a real estate professional on paper and I can utilize these Passive Losses to offset active income.

My life has changed forever.

I’m not here to brag but urge you to stop paying your unfair share of taxes by the following:

- Move to be a "real estate professional"

- Invest in deals that give you depreciation or better yet bonus depreciation via cost segregations. Being a private money lender will not get your depreciation... I don't know why so many people do that!

If you are still using “1031 exchanges” in your vocabulary you need to stop thinking that is a good option (and need to change your network) as Bonus Depreciation has made 1031 Exchanges obsolete. For those Accredited investors, you might want to think about using Land Conservation Easements as a means to get your active income down.

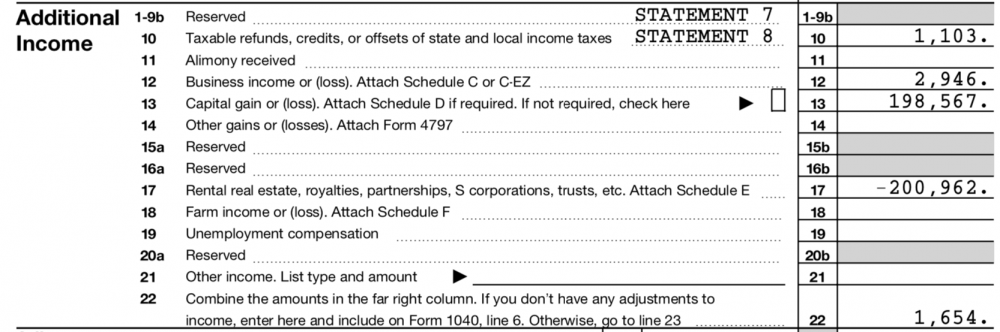

At least that is what my tax guy and my screenshot of my tax return is saying below:

I had $200k of gains which got extinguished with the depreciation from the bonus depreciation. I had a bunch more depreciation I did not use in 2018 so I get to save that for the future.

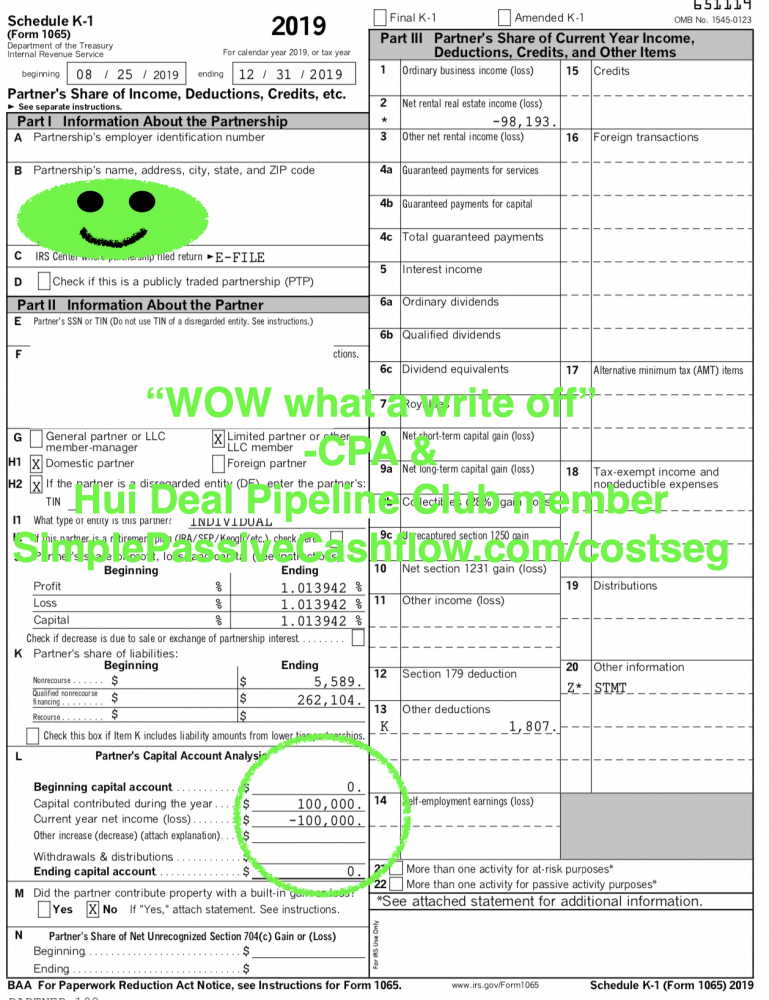

Sample K1

Going to withdraw from a retirement account? Is the adjusted gross income too high to absorb selling off assets?

Here is a sample K1 from an investor who invested 100k with us and got 98k back in year one paper losses to help absorb those gains.