Introduction

Welcome

Investor Type

Syndication Investors

Turnkey Investor Education

Hui Hacks

Investor Type (Part 2)

HUI Mastermind

HUI Highlights

Cost Segregations Pt. 1

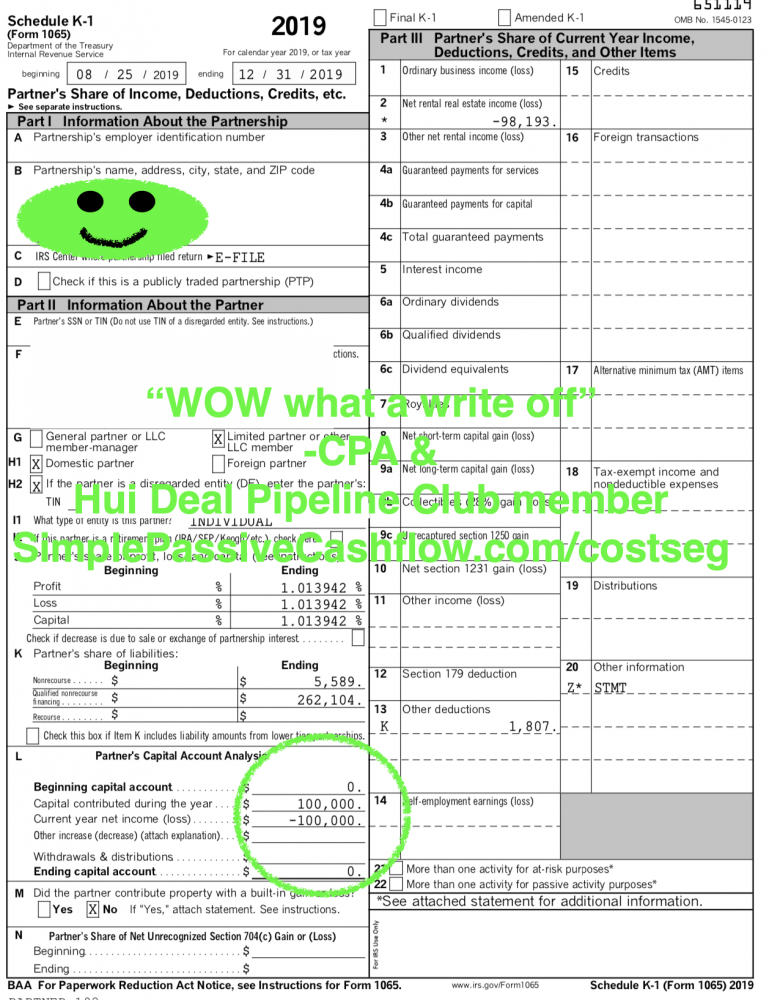

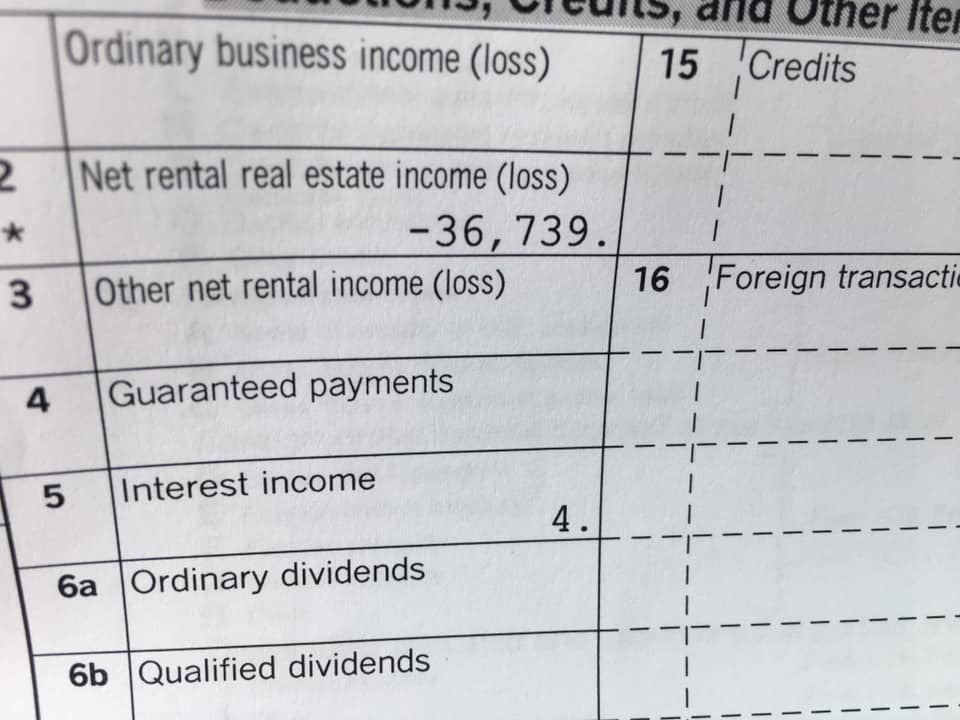

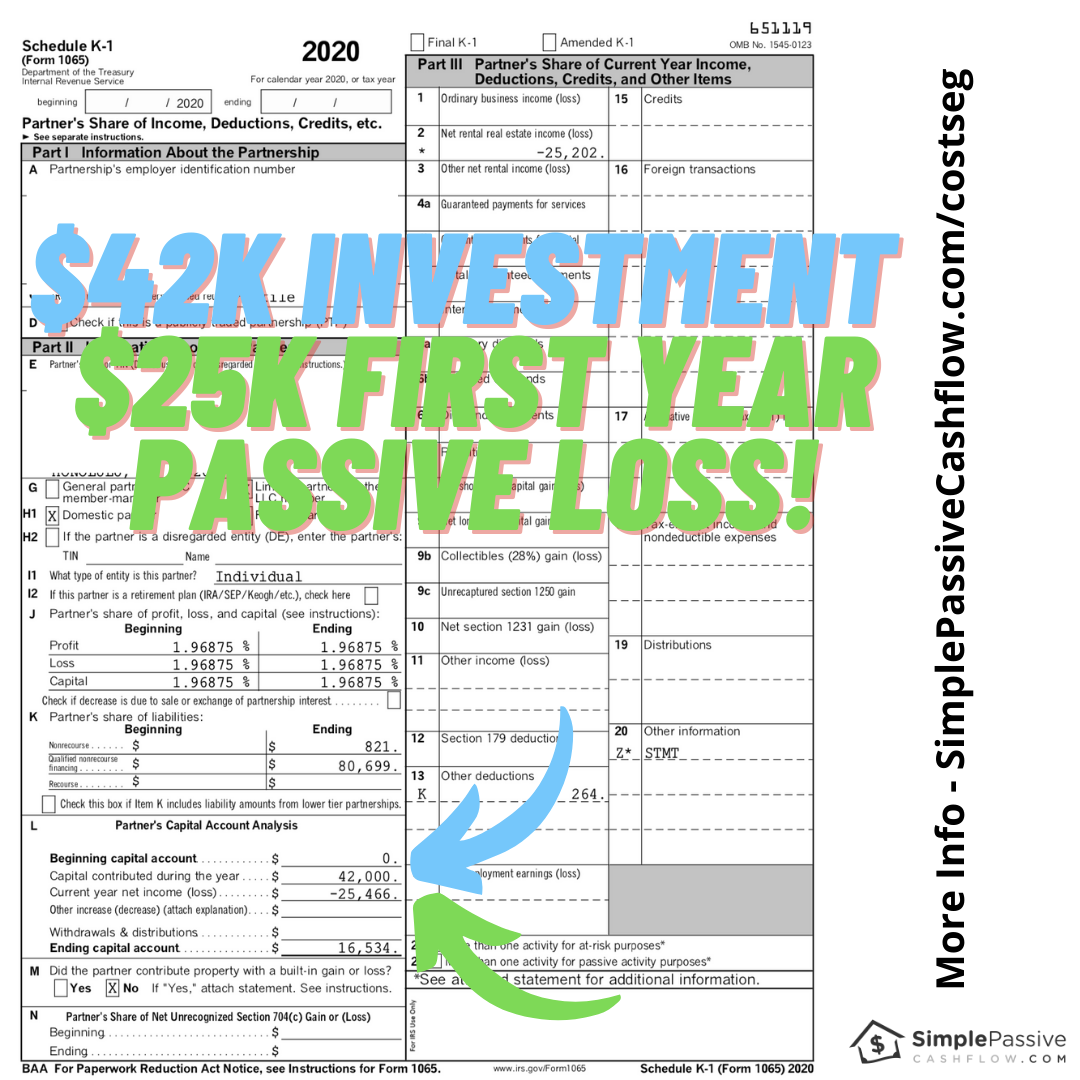

On larger deals, we do cost segregations to write off most of the profits we make and sometimes even some of our W2 income! But that’s getting more into the weeds with taxes.

Not making any promises as depreciation amount is primarily based on building specifics and amount of leverage used in a deal but here is a real-life example from a $50K investment in the first year K-1 in 2018 utilizing cost segregation.

Download the Return on Equity spreadsheet to see where your lazy equity is. Sell those assets and get that lazy equity working! But make sure to get those passive losses racked up so you can mitigate capital gains without a 1031 exchange. More info about the Return on Equity concept.