2 || Financial Solvency

O b j e c t i v e s

After studying this course, you should be able to accomplish the following:

Explain the importance of analyzing personal finances, using financial statements

Create and analyze personal net worth statements

Create and analyze personal income statements

Create and analyze personal cash flow management statements

Create and analyze personal financial ratios from personal financial statements

Make use of financial statements and rations to plan personal finances

Type or write out your honest and thorough answer:

- How well do you manage your current finances?

- How would tracking your expenditures help you?

- What might be the benefits of discovering where your money is spent?

One way to manage your money correctly is to view yourself as an entrepreneur running a business. You have revenue and costs which need to be tracked and controlled. You must set goals and practice discipline in order to be profitable. You need to be alert to what resources you have and do not have. Knowing where you are at any given time can allow you to understand how the different components of your finances are interrelated. This will especially help you monitor your financial progress and identify any shortfalls.

Therefore, in order for you to control your financial future, you must understand where you stand financially. Just as an explorer has tools to assist him or her to navigate uncharted territory, an individual on the road to financial independence also needs tools. Financial statements are tools that allow you to develop a roadmap to where you want to go. Businesses use financial statements to determine profitability and to plan for future success. You should do the same.

The following are three key financial statements that you should consider using (a brief explanation of each follows):

- Net Worth Statements

- Income and Expense Statements

- Cash Flow Management Statements

The Net Worth Statement is a straightforward, objective tool that lets you know where you stand financially. It allows you to calculate your net worth by subtracting the total amount of everything you owe (liabilities) from the value of everything you own (assets). In other words, the difference between your assets and your liabilities equals your net worth.

The net worth statement may also be used as a measuring tool for your financial progress. If your net worth is positive, congratulations! But if it is negative, you really need to work on your finances. Your goal should be to raise your net worth on a REGULAR BASIS—the higher, the better!

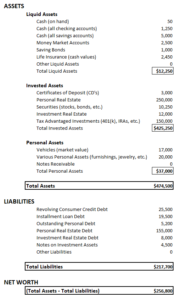

Ex. Personal Net Worth Statement

Prepared for the Year Ending Dec 31, 2007

One of the first steps to creating a net worth statement is calculating your assets. Net worth assets are generally separated into three subcategories: liquid assets, invested assets, and personal assets.

- Liquid Assets

Liquid assets are like cash or anything that can be easily converted into cash within 30 days or less. Such assets include on-hand cash, checking accounts, money market accounts, savings accounts, saving bonds, and the cash value of a whole life insurance policy. Liquid assets may include resources, which are not earning much in interest and/or could be used to pay down debt.

- Invested Assets

Invested assets are any investments that are hopefully earning a profitable amount of interest. These include such things as Certificates of Deposit (CDs), work-sponsored retirement plans, Individual Retirement Accounts (IRAs), pensions, and brokerage accounts with stocks, mutual funds, etc. They may also include more significant investments, such as your home and other investment properties. The important thing to remember about these assets is that they should be working for you and making you money (increasing in value). If you find that some of your investments are not profitable, you need to reevaluate those investments. Invested assets that are losing money may be more of a liability than an asset!

- Personal Assets

Personal assets are such items as automobiles, home furnishings, jewelry, antiques, valuable collections, and all other personal items that you possess. Notes that you hold or accounts receivable can also be considered personal assets. The value of personal items can sometimes be difficult to estimate, so make sure that you do not under-value or over-inflate what you think these items are worth.

The value of all three subcategories totaled equals your gross assets. Be sure to list the fair market value of all assets regardless of any outstanding liens or remaining scheduled debt payments.

Liabilities are amounts of money owed. They are any debts that you owe to a lender, whether individual or institutional. Remember to list ALL the debts that you owe, as this will help you to more accurately determine your net worth. Subcategories of liabilities are listed below:

- Revolving Credit Lines (including bank, store, gasoline, and major credit cards)

- Installment Loans (including student loans, auto loans, etc.)

- Notes on Real Estate (including primary and second mortgages and home equity lines of credit)

- Notes on Investment Real Estate (including rental properties, non-developed land, time-shares, etc.)

- Personal Notes (owed to individuals or institutions)

- Notes on Invested Assets (such as loans against personal long-term investments, including 401(k), 403(b), or whole life insurance policies)

The total of all subcategories equals your gross liabilities.

Note: Listing your debts also helps you to organize and prioritize your liabilities Listing your debts correctly is an important process that can help you to identify which loans are short-term and which are long-term. You can prioritize those debts that need to be paid off quicker and determine if several debts need to be consolidated at a lower interest rate. After overcoming the initial shock, you may be surprised at how genuinely useful it is to list all of your debts— seeing truly is believing.

Once your net worth statement is complete (by subtracting gross liabilities from gross assets), you now have determined your net worth. You can use it to help you reach your financial objectives. For example, the statement can show your progress in eliminating debt, accruing and maximizing assets, and expanding financial growth. You will also discover that if all your debts are paid off, the amount you were spending to pay those debts will now be available to use for future wealth building.

You should review and revise your net worth statement at least once every three months, and you should compare your net worth figures from year to year. Use these comparisons to make sure that you are meeting current obligations and are on track for future financial stability. Your initial goal should be to increase your net worth by $500 to $1,000 a month. This could be accomplished by paying off debt and not accruing any new month-to-month liabilities.

Your net worth is the best measurement of your financial wealth. Wealth building is essentially net-worth building. However, be sure to keep your long-term goals in mind because you will want to build net worth that can be converted into income streams when you retire. For instance, it is often a mistake to purchase a house that is larger than you really need. Even though it can increase your net worth, particularly through appreciation, it will not provide an income stream during your retirement years (unless you sell it to downsize or take out a reverse mortgage). In fact, a larger retirement home is simply a collection of larger costs: insurance, taxes, maintenance, etc.

The following page contains an example of a net worth statement. You will notice that it has been completed for illustrative purposes. (A blank statement is available for your use here: Personal Net Worth Statement. You should modify the statement to fit your particular circumstances.)

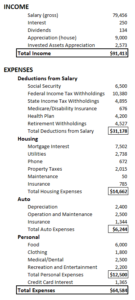

The income and expense statement is a time-specific record (best prepared quarterly and/or annually). On this statement, you list all of your income and all of your expenses for the period. At the end of the statement, you subtract your total expenses from your total income—the result will be either a profit or a loss. This statement indicates where your resources are coming from and where they are going. In other words, this statement helps you to SEE where your money goes; thus, you should be able to control it better in the future.

The net worth and income and expense statements work together. Your profit or loss should be an exact reflection of your net worth for that particular period. Remember, your goal is to always make a profit!

The following are examples of how an income and expense statement can be helpful:

- If you own a house, it should appreciate over time. Unless it is written down for you to see, you may not realize the appreciation as an increase in net worth.

- If you are a wage earner, you typically have deductions (taxes, insurance premiums, flexible spending accounts, etc.) withdrawn from your pay before it is deposited into your checking account. These expenses need to be included in the statement. It is important to know what deductions are removed from your income so that you will be able to realize the net amount of income that you have to work with.

One of the great things about the income and expense statement is that it will show you where you can take immediate action to reduce expenditures and/or to increase your cash flow, in order to increase your overall net worth. The statement also establishes how well your finances are doing from one period to the next. You will notice that when you pay down your debts, you are actually increasing your net worth. Why is this so? As your debts (liabilities) decrease, your assets remain the same; thus, your net worth will automatically increase!

The following is an example of an income and expense statement. You will notice that it has been completed for illustrative purposes. (A blank statement is available for your use here: Income and Expense Statement. You should modify the statement to fit your particular circumstances.)

Income and Expense Statement

Prepared for the Year Ending Dec 31, 2007

The cash flow management statement shows the inflow (income) and outflow (expenditures) of money during a particular period of time (usually monthly and summarized annually). It allows you to track your cash resources (and their usage) to cover out-of-pocket expenses. In its most simplistic form, a check register could be considered a cash flow statement. However, the important thing to consider is that there is a distinct difference between cash flow and income. To most people, the cash flow management statement looks like a budget sheet.

The income and expense statement and the cash flow management statement have similar categories; however, the cash flow statement tracks only the cash resources you bring in and spend. (The greater the detail when listing your expenditures, the easier it is to identify where your money is going!) It does NOT list non-cash incomes and expenses, such as home appreciation or the depreciation of an automobile. The cash flow statement should help you to understand what your greatest cash expenses are. The statement also tells you whether you have enough cash on hand to meet your liabilities and whether you have enough resources for an additional cash margin that can be used to pay down debt. (This will be addressed further in the Cash Flow Management course.)

The cash flow management statement will be the pulse of your financial health. It is something you should refer to often and update monthly! Your objective with this statement is to show slightly more cash at the end of each month, or at least to break even.

The statement is often grouped into the following sections:

- Income: This includes regular and irregular sources of income: Personal loans or credit card advances

- Regular Income: Primary and secondary sources of employment (your and/or your spouse’s, etc.). Ask yourself, Is there more than one source of income coming from an employer? All sources of income from employment are detailed in this section and RECORDED IN GROSS AMOUNTS PRIOR TO TAXES!

- Irregular Income: All sources other than employment, such as the following:

- Dividends from investments and interest from savings accounts

- One-time payments, such as bonuses or tax refunds

- Transfers from savings accounts

- Cash carryover from the previous month’s expenses

- Withholdings: Taxes and program withholdings (taxes, health plans, cafeteria plans, retirement plans, etc.).

- Savings: Any monies that you have saved (emergency, college, etc.).

- Expenditures: Includes everything that you must pay for during the month:

- Fixed Expenses (mortgages, rents, charitable contributions, etc.)

- Loans (auto, student, credit card, personal, etc.)

- Household Expenses (utilities, insurance, groceries, repairs, etc.)

- Flexible Expenses (clothing, entertainment, dining out, cable/satellite, Internet, etc.)

Note: Taxes and all withholdings need to be listed on a monthly basis because they act as a motivator to find alternative means to lowering overall tax liabilities. They also offer a clearer picture of one’s operating capital, which is used for all fixed expenditures.

Hopefully, your statement will realize a positive net cash flow; however, sometimes you might experience a negative amount because you spend more than you made (as illustrated in the statement below). Many people become discouraged when this happens month after month. They often find themselves in a never-ending cycle of living paycheck-to-paycheck, and they are unable to pay more than the minimum required payments on their debts. This behavior can lead to financial ruin, divorce, and bankruptcy!

The good news is if you track your expenditures, and really understand where your money is going, it becomes much easier to hold on to what you earn. What truly matters is not how much you make—IT IS WHAT YOU KEEP THAT MAKES YOU RICH. You can be broke or wealthy at any income level. The choice is yours.

The following page contains an example of a cash flow management statement. You will notice that it has been completed for illustrative purposes and the numbers have been rounded to the nearest dollar, as monthly figures will vary. (A blank statement is available for your use here: Cash Flow Management Statement. You should modify the statement to fit your particular circumstances.)

Cash Flow Management Statement

Prepared for Month of November 2007

In addition to the preceding statements, the following are benchmark ratios that you can calculate utilizing the statements. They are quick reminders that can help you determine if you are on the right financial track.

Note: In order to obtain a percentage from the following ratios, multiply the result by 100. For example, if you calculate your ratio and the answer is 0.125, you would multiply the answer by 100. The result would be 12.5, thus your ratio would be 12.5%.

Debt-to-Income Ratio

The debt-to-income ratio is used by lending institutions to qualify clients for loans. This ratio is calculated by dividing your debt payments by your gross income (prior to withholdings). The resulting ratio will tell you what percentage of your income is being used to service your debts. The national average is 38%, and the lower the number the better. (The figures for this ratio are found on the cash flow management statement and the income and expenses statement.)

Debt-to-Income Ratio = Debt Payments / Gross Income

Debt-to-Asset Ratio

The debt-to-asset ratio is an excellent way to determine your financial solvency. It shows the percentage of your assets that are financed through debt. In other words, it shows you what percentage of your gross worth is debt! Calculate this ratio by dividing your total liabilities by your total assets. You will want the ratio to be as low as possible, as this will show that you have more assets than liabilities. You will also want this ratio to decrease every year. (The figures for this ratio are found on the net worth statement.)

Debt-to-Asset Ratio = Liabilities / Assets

Note: Liabilities may also be thought of as the portion of your assets that are owned by your creditors rather than by you. So, the lower your debt-to-asset ratio, the more of the assets you actually own. In addition, your net worth should be increasing in direct proportion to this ratio’s decrease.

Liquidity Ratio

The liquidity ratio represents the ability of an asset to be converted quickly and easily into cash. This ratio also shows the number of months a household could continue to meet its expenses from those liquid assets after a total loss of income. The ratio is calculated by dividing your liquid assets by your total monthly expenses. This number is important because it can apprise you of funds that you might need in case of an emergency. Upon calculating this ratio, you should plan for the equivalent of three to six months of living expenses.

It is a commonly held belief that most people, when faced with a total loss of income, are two to three months (or less) from complete financial ruin—meaning they will eventually end up in bankruptcy court. If your liquidity ratio is low, then you obviously need a plan to augment your liquid assets and contingency savings, so that basic living expenses can be met during times of hardship or emergency. (The figures for this ratio are found on the net worth statement and on the income and expense statement.)

Liquidity Ratio = Liquid Assets / Total Expenses

Debt Service Ratio

The debt service ratio is an estimate of debt payments to take-home pay. This ratio is similar to the debt to income ratio, but it only involves cash flow. It is calculated by dividing debt payments by take-home pay. A ratio under 50% indicates adequate cash flow to cover debts and liabilities. If this ratio is high, cash flow most likely needs to be streamlined by looking for financial leaks. Find out where your money is being wasted and put it to optimal use. (The figures for this ratio are found on the cash flow statement.)

Debt Service Ratio = Debt Payments / Expendable (Net) Income

The following is an example of how to calculate the ratios discussed in this course. The figures used in this example are taken from the preceding statements and are totals for an entire year (January to December).

We may now use the preceding information to calculate the following ratios:

Drawing from the knowledge you have gleaned from this course, take the following post-test.

- What are liabilities and why is it important for you to prioritize them?

- Why is a proper cash flow management system important?

- How could you best manage your cash flow?

Assignments

The following assignments are designed to help you implement the information within this course:

- Check the Glossary for recommended reading & descriptions of financial terms.

- Complete your own Net Worth, Income and Expense, and Cash Flow Management statements. (Blank forms of each are available here: Personal Net Worth Statement, Income and Expense Statement, Cash Flow Management Statement. You should modify them to fit your particular circumstances.)

- Calculate the following ratios from your statements and evaluate your current financial standing:

- Debt-to-Income

- Debt-to-Asset

- Liquidity

- Debt Service

- Using the aforementioned statements and ratios, plan a usable cash flow management plan (or a financial strategy) for the following months, quarters, and remainder of the year.

Liabilities are monies owed. They are any debts that you owe to a lender, whether individual or institutional. Prioritizing your liabilities helps you to identify the liabilities that need to be paid off faster.

It allows you to track your cash resources to cover out-of-pocket expenses. The cash flow management statement shows the inflow and outflow of money during a particular period of time.

- Debt-to-Income Ratio: Lending institutions use this ratio to qualify clients for loans. This ratio is calculated by dividing your debt payments by your gross income. The resulting ratio will tell you what percentage of your income is being used to service your debts. The national average is 38%, and the lower the number the better.

- Debt-to-Asset Ratios: This ratio is an excellent way to determine your financial solvency. It shows the percentage of your assets that are financed through debt. This ratio should be as low as possible, as this will show that you have more assets than liabilities.

- Liquidity Ratio: This ratio represents the ability of an asset to be converted quickly and easily into cash. This ratio also shows the number of months a household could continue to meet its expenses from those liquid assets after a total loss of income.

- Debt Service Ratio: This ratio is an estimate of debt payments to take-home pay. This ratio is similar to the debt to income ratio, but it only involves cash flow. A ratio under 50% indicates adequate cash flow to cover debts and liabilities.