1 || Financial Planning: A New Fiscal Beginning

O b j e c t i v e s

After studying this course, you should be able to accomplish the following:

Identify the pitfalls of financial dependence.

Define financial independence.

Complete a Personal Financial Vision Quadrant.

Complete a Definition of Wealth and a Personal Financial Wealth Commitment.

Explain the three stages of the financial planning process.

Start by asking yourself:

- What does financial independence mean to you?

- What does it mean to be wealthy?

Take note of your answers.

Just for fun, what would it be like to spend Bill Gates’ money?

Financial independence (n.): the objective of any working individual

So, why do you work? Is it to make enough money so you can stop working? Or is it to have so much money that you can live the lifestyle of your dreams? What about being able to retire without a home mortgage and having enough money each month to pay the bills? All are very valid and even more real answers.

Then again, a fundamental definition may simply be the ability to sustain oneself financially. Whatever the reason, you are likely using this course to become financially independent.

So stop and ask yourself the question: Why am I not financially independent?

There are three main reasons for any person failing to gain financial independence:

- Lack of knowledge

- Fear

- Procrastination

The main purpose of this course is to educate you. It is said that knowledge is power. With the knowledge that you gain, your confidence to manage your finances should increase and your financial fears should dissipate. However, procrastination is will always pose a predicament…

Too many people think that life is all about money. Money is a tool that makes the rollercoaster of life bearable and more enjoyable. This program is designed to teach you how to control your finances, instead of them controlling you.

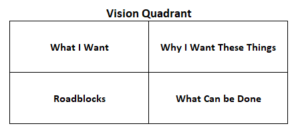

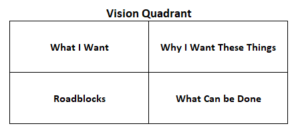

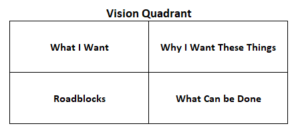

The first step towards controlling your finances is deciding what you truly want to achieve. To accomplish this aim, we recommend using a simple exercise called the Vision Quadrant.

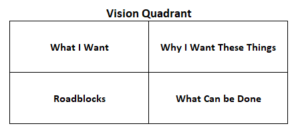

The Vision Quadrant is an exercise in brainstorming. It is designed to help you create a vision of what you truly want. You may use this exercise for anything you desire, such as financial, family, spiritual, or physical goals; but for now, we will focus on financial goals. The main point of this exercise is to help you to visualize your financial potential and to realize what has been impeding your financial progress. Refer to the following chart, as we discuss the particulars about the Vision Quadrant. (A full-sized chart is available here: Vision Quadrant.)

There are four sections: what I want, why I want these things, roadblocks, and what can be done. Now is the time to grab a pen and paper.

What I Want:

Begin with the first quadrant entitled “What I Want.” In this quadrant, write down all of your financial desires. And the number one rule of thumb here is to be honest. There is no right or wrong desire.

Ask yourself: what is it that I truly want to have in this life? Flying cars? A floating mansion? The sky is the limit. Write down anything and everything you want.

And then ask yourself: do I have target dates in mind for these desires?

Why I Want These Things:

In the second quadrant, write down your answers to why you want those things. Think about why these things are important to you. Sometimes the answers are obvious; however, sometimes the answers will require some serious reflection. You may find that some of your financial desires are not as important as you first thought.

Take this quadrant seriously. It is the most important step in this exercise.

Roadblocks:

In the third quadrant, list roadblocks to those things that you want. Most likely, these roadblocks are personal weaknesses that have been holding you back. Ask yourself the following questions:

What are my weaknesses?

What am I afraid to do?

What things do I do that I know that I should not do?

Be brutally honest with your answers—being honest and critical is the first step towards overcoming any obstacle. Besides, you are the only person who will be reading your Vision Quadrant.

What Can be Done:

In the last quadrant, look for unturned stones. Ask yourself: what are some ideas that could help me to reach the end result, but I have never given it much more than a passing thought? Have any ideas that really could lead you to your pot of gold? Is there a business venture that you have always wanted to take a crack at? Is there an investment avenue that you have wanted to investigate? Are there any detours from the mundane that you have been itching to scratch? Do not be afraid or ashamed to THINK BIG.

The brainstorming in this part of the exercise is meant to help you establish possible solutions to help you reach your desires. Any possibility, no matter what it is, merits attention.

Once complete, use the exercise to contemplate your financial future and to visualize what it will be like when you are truly wealthy. In addition, ask yourself such questions as:

What am I doing with my time?

What investments am I controlling?

Who am I helping?

In the future, make this a dynamic exercise by updating the quadrants as new ideas come to mind.

Financial principles are timeless, while financial strategies are timely and ever changing. Your financial future is yours to determine and control.

Creating and sustaining a plan that is based upon solid financial principles is the key to your future success. However, your plan has to begin with a belief, which is the preparatory point of any action. A common motto states, “If you can believe it, you can achieve it.”

A crucial factor in supporting your foundation and financial plan is the core belief that all goals can be obtained within a specified period of time. So make the commitment now.

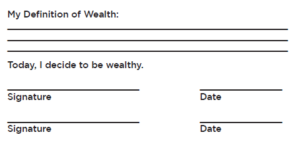

I hope you still have your pen and paper out. Create your own wealth commitment by using the template below (a full-size template is available here: Wealth Commitment).

On your statement, put into writing your definition of wealth. Besides financial wealth, wealth can exist in many ways, such as family, health, relationships, solid business relationships, knowledge, wisdom, etc. Wealth is far more encompassing than one’s net worth. True financial wealth is having the financial means to care for all of one’s needs and wants—with ample leftover to help others. Take time to ponder what being truly wealthy means to you and use this to manifest destiny.

With the courses that follow, we shall begin the financial planning process! Over the course of creating a detailed financial plan, you will learn about many subjects relating to your financial wellbeing. We will cover these topics in a purposeful order, starting with the basics of financial management and moving on to matters that are more complicated. The process will involve the following three stages:

- Future Finances

What do you want to achieve in life? Where do you see yourself financially in the near and distant future? Do you have a financial vision of your future? This program will help you describe your financial future in every detail. You will then learn how to see your future through the powerful art of visualization. Once you have seen your future in all of its detail, you will then map the course to your financial destination.

2. Current Finances

Future courses will help you to bring your current financial picture into focus, down to the smallest detail. You will know exactly where you stand financially. This creates your baseline—your starting point from which you will begin your financial future.

3. Make it Happen

After you have visualized your future and determined your current situation, you will learn how to transform your financial desires into reality. You will make this happen through saving and investing your money, finding every opportunity to make your money grow, and protecting it once you have it. Then you will be on your way to achieving your long-term financial goals!

Viewing the process in three stages may help you to realize the logic behind the topics in this program. During this process, you will learn how to create your own personal financial statements and decipher what they mean to you. You will learn how to manage your money so that your hard-earned cash stops slipping through your fingers. Through risk management strategies, you will learn how to prepare for the unexpected. You will find ways to save money in virtually every area of your life. Moreover, one of the greatest objectives of this course is to help you create a detailed debt elimination plan, which will put you on track to a life free from personal debt!

Within a relatively short period, you will understand what is meant by the saying. “If you don’t know where you’re going, any road will take you there.”1 You will want to know where you are going financially; otherwise, you may end up financially lost. You should become desperate to put your finances in order. Ask yourself such questions as, How will I save enough money for the future?; How will I make my money work for me so that someday I will not have to work for it?; How can I increase my cash flow and speed up my journey towards financial independence? These are all questions to which you will learn the answers in the courses that follow.

Two other important questions that are often asked are, Once I have it, how do I hold onto it? and How do I preserve it for future generations? To answer these questions, you will need to learn about asset protection, tax planning, and estate planning.

By the time you are finished with this financial planning process, you will be more financially literate than most. You will have incorporated sound financial principles into your life and you will have practical financial management skills that will take you to where you ultimately want to be—living a life of financial independence!

You’re in the phase of your life where your financial goals are shifting from survival mode in your college and graduate school years to survival mode of balancing present financial needs with saving for the future.

Maybe you’ve gotten married, had a kid or two and are trying to buy a home.

On the other hand, maybe you love single life, have a dog and are in the same boat.

Whatever your life choices are, your 30s and 40s have unique challenges and opportunities when it comes to money.

Don’t be intimidated by the length of it, this detailed checklist is designed to help you minimize the challenges and maximize the opportunities. As a bonus for downloading this guide, you also get access to a free, 15-minute strategy session to help you apply this information specifically to your situation.

- Savings/Cash Flow:

- Have 3-6 months of living expenses saved in a savings or money market account

- Automate as much of your bill payment, savings and budgeting as possible so you can increase your chances of staying on track

- Debt Reduction

- Have an accurate and up-to-date list of all debts owed

- The total payoff amount

- The interest rate

- The minimum monthly payment

- Create a plan on how to pay the debt off

- Debt snowball – pay the lowest balances off first

- Debt avalanche – pay the highest interest rates off first

- Retirement

- Contribute at least up to the company match for 401(k) and 403(b) plans

- Consider maxing out your Roth IRA account (currently $6,000 per year)

- Understand the difference between Traditional and Roth accounts

- Determine your risk tolerance

- Apply your risk tolerance profile to your investment selections in both retirement and non-retirement accounts

- Try to save 15% of your income into retirement

- Don’t dip into your retirement accounts or use them as backup savings

- Home Ownership

- If you are in the home buying process, consider applying for various grants and programs that reduce the amount of down payment needed (i.e. FHA loans, NACA, industry-specific grants)

- If you currently own a home, compare your interest rate to current rates to see how much you could potentially save by refinancing

- Risk Management

- Review your insurance coverage for life, health, car, disability and umbrella insurance

- Increase or obtain coverage as necessary

- At a minimum, consider term life insurance to cover your outstanding debts and loss of income

- Consider cash-value whole life insurance while you’re still young enough to get reasonable rates

- Estate Planning

- Create a will

- Create a durable power of attorney for healthcare and financial matters

- Make sure your beneficiaries are up to date on retirement plans and other accounts – if you got married, divorced or have had children this is very important

- Other Wise Points

- Don’t try to keep up with the Jones’ – live a lifestyle that doesn’t stress you out financially

- Get sound financial advice from fee-based financial planners that understand your goals and won’t ignore you because you don’t have millions of dollars in your account

- Diversify your income – figure out how to create a stream of income from something outside of your primary vocation

Author William James once stated, “Human beings, by changing the inner attitudes of their minds, can change the outer aspects of their lives.”

This quote encompasses one of the major aspects of this Financial Planning Course Series. This program is designed to be a new beginning for those who work it. It can be a catalyst to a new lifestyle for the remainder of your life!

By implementing the tools and knowledge in this Financial Course Curriculum, you should have the skills and ability to overcome many financial obstacles. For example, the Vision Quadrant is a model of what you are seeking to accomplish (it will be referenced in future courses). As you complete each course, you will find new means to overcome barriers that have held you back or that have limited your financial success.

Take each exercise in this manual seriously. Put forth your best efforts into every aspect of this program. If you do so, you should meet objectives that have eluded you in the past.

After completing the Wealth Commitment exercise and defining what wealth means to you, place the document where you will notice it on a regular basis. Use it to remember your obligation to yourself.

Finally, remember that wealth building is a process and time is a key element. You did not end up in your current financial situation overnight and you will not resolve it overnight. Author Brian Adams stated it best when he wrote, “Learn the art of patience. Apply discipline to your thoughts when they become anxious over the outcome of a goal. Impatience breeds anxiety, fear, discouragement, and failure. Patience creates confidence, decisiveness, and a rational outlook, which eventually leads to success.”

Let’s see what you got out of the lesson so far!

- What are the three main reasons for personal shortcomings and failings in life?

- What is the vision quadrant and why is it important?

- What are the three stages of the Financial Planning Process?

The three main reasons for any person failing to gain financial independence are lack of knowledge, fear, and procrastination. The main purpose of this course is to educate you. It is said that knowledge is power. With the knowledge that you gain, your confidence to manage your finances should increase and your financial fears should dissipate. However, procrastination is always a quandary.

The Vision Quadrant is an exercise in brainstorming. It is designed to help you create a vision of what you truly want. You may use this exercise for anything your desire, such as financial, family, spiritual, or physical goals; but for now, focus on financial goals. The main point of this exercise is to help you to visualize your financial potential and to realize what has been impeding your financial progress.

Future Finances: This program will help you describe your financial future in every detail. You will then learn how to see your future through the powerful art of visualization. Once you have seen your future in all of its detail, you will then map the course to your financial destination.

Current Finances: Future courses will help you to bring your current financial picture into focus, every tiny detail of it, so that you know exactly where you stand financially. This creates your baseline—your starting point from which you will begin your financial future.